Guide to the Markets

MARKET INSIGHTS Guide to the Markets UK | Q1 2017 | As of 31 December 2016

Global Market Insights Strategy Team Americas Europe Asia Dr. David P. Kelly, CFA Stephanie H. Flanders Tai Hui New York London Hong Kong Anastasia V. Amoroso, CFA Manuel Arroyo Ozores, CFA Yoshinori Shigemi Houston Madrid Tokyo Julio C. Callegari Tilmann Galler, CFA Marcella Chow São Paulo Frankfurt Hong Kong Samantha M. Azzarello Lucia Gutierrez-Mellado Kerry Craig, CFA New York Madrid Melbourne David M. Lebovitz Vincent Juvyns Dr. Jasslyn Yeo, CFA New York Luxembourg Singapore Gabriela D. Santos Dr. David Stubbs Ian Hui New York London Hong Kong Abigail B. Dwyer, CFA Maria Paola Toschi Akira Kunikyo New York Milan Tokyo John C. Manley Michael J. Bell, CFA Ben Luk New York London Hong Kong Ainsley E. Woolridge, CFA Alexander W. Dryden, CFA New York London Hannah J. Anderson Nandini L. Ramakrishnan New York London For China, Australia, Vietnam and Canada distribution: Please note this communication is for intended recipients only. In Australia for wholesale clients use only and in Canada for institutional clients use only. For further details, please refer to the full disclaimer. Unless otherwise stated, all data is as of 31 December 2016 or most recently available. 2

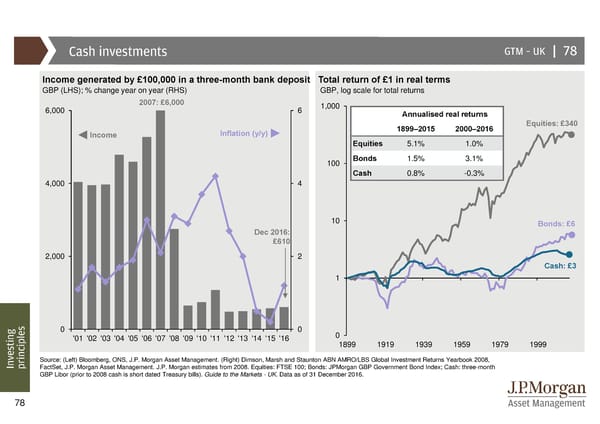

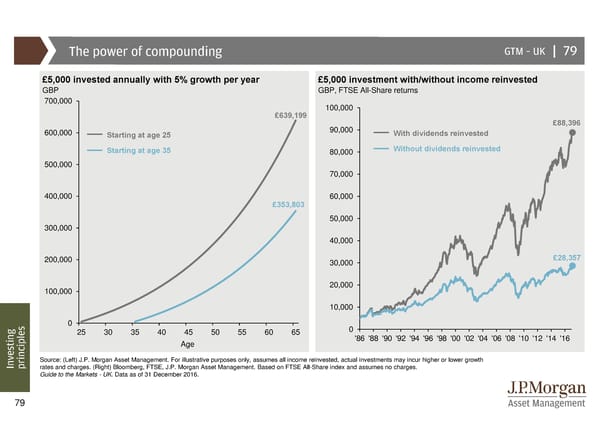

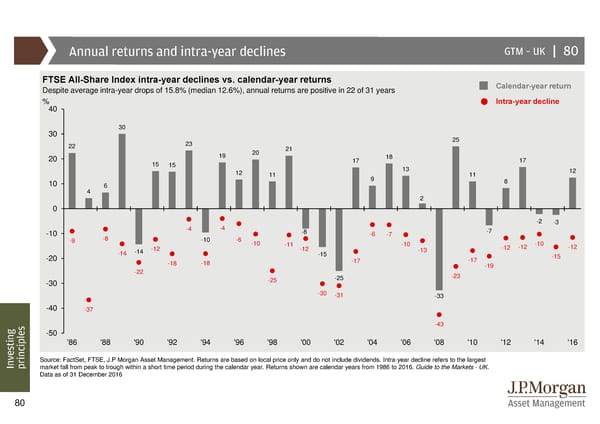

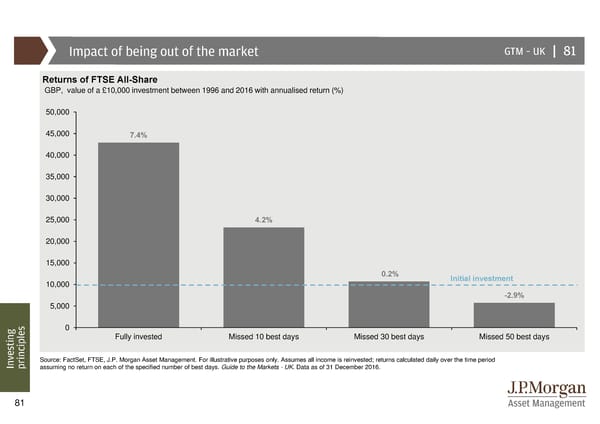

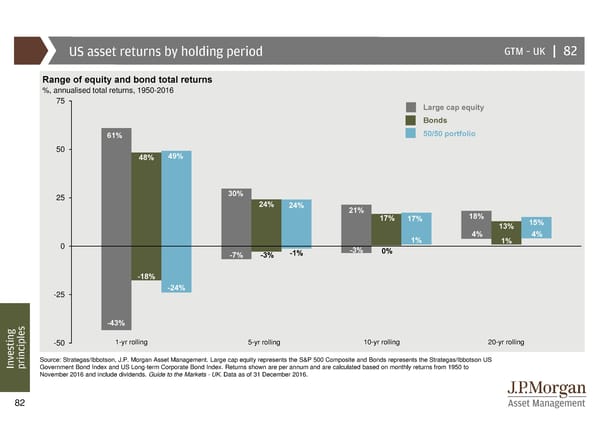

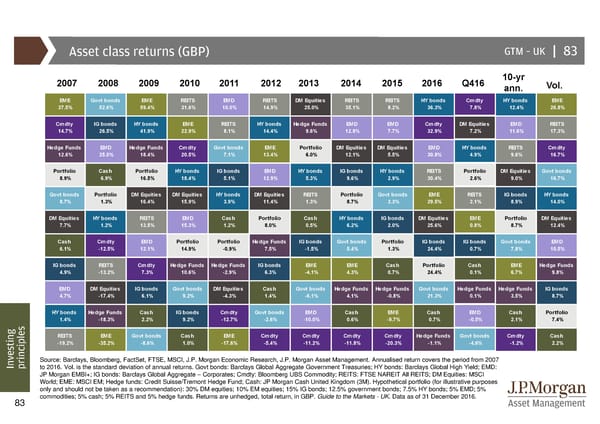

Page reference UK economy 45. UK FTSE All-Share equity valuations 4. UK: GDP and inflation 46. US S&P 500 at inflection points 5. UK labour market dynamics 47. US equities 6. UK growth monitor 48. US S&P 500 equity valuations 7. UK housing 49. Equity markets and reflation 8. UK consumer finances 50. US bear markets 9. Brexit: The UK and the EU 51. Interest rates and equities Global economy 52. Japanese equities performance and drivers 53. Developed market equity valuations by country 10. Global Purchasing Managers Index (PMI) for manufacturing 54. Emerging market equity valuations by country 11. Global inflation dynamics 55. Emerging markets: Valuations and returns 12. Nominal GDP and inflation outlook 56. Emerging markets: Investment drivers 13. Global central bank policy 57. Emerging markets: Flows, earnings and income 14. Fed funds long-run expectations 58. Equity income 15. Global supply dynamics Fixed income 16. Developed market fiscal policy 17. Global currency trends 59. Global fixed income: Yields and returns 18. Eurozone: GDP and inflation 60. Fixed income interest rate risk 19. Eurozone growth monitor 61. Inflation implications for fixed income 20. Eurozone recovery monitor 62. Liquidity risks 21. Eurozone credit conditions 63. Historical yields of government bonds 22. European Central Bank (ECB) policies 64. Government bond yields 23. European politics 65. Global investment-grade bonds 24. US: GDP and inflation 66. Global investment-grade bond market 25. US Federal Reserve outlook 67. US high yield bonds 26. US labour market 68. European high yield bonds 27. US growth monitor 69. Emerging market debt 28. US consumer finances Other assets 29. Long-term drivers of US economic growth 30. US fiscal policy 70. Commodities 31. Japan: GDP and inflation 71. Oil market drivers 32. Japan: Abenomics and the economy 72. Gold market dynamics 33. China: GDP, inflation and policy rate 73. Risk-adjusted returns and downside protection 34. China economic indicators 74. Alternative strategies 35. China financial dynamics 75. Correlation of returns (GBP) 36. Emerging market adjustments 76. Asset markets in coming decades 37. Globalisation and trade Investing principles Equities 77. Life expectancy 38. World stock market returns 78. Cash investments 39. European sector returns and valuations 79. The power of compounding 40. MSCI Europe ex-UK performance and drivers 80. Annual returns and intra-year declines 41. MSCI Europe ex-UK equity valuations 81. Impact of being out of the market 42. UK FTSE All-Share at inflection points 82. US asset returns by holding period 43. UK equities 83. Asset class returns (GBP) 44. UK equities post-referendum 3

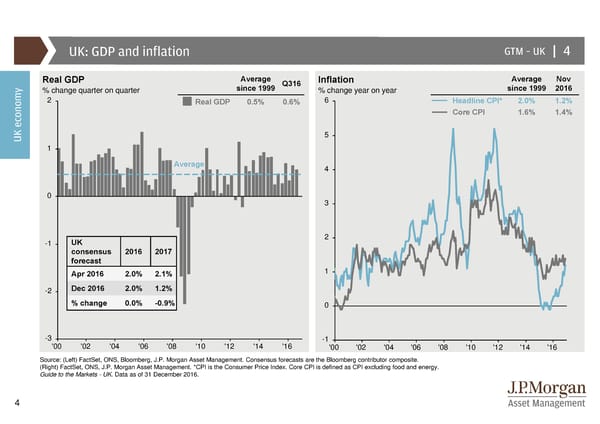

UK: GDP and inflation GTM –UK | 4 Real GDP Average Q316 Inflation Average Nov y % change quarter on quarter since 1999 % change year on year since 1999 2016 2 Real GDP 0.5% 0.6% 6 Headline CPI* 2.0% 1.2% Core CPI 1.6% 1.4% UK econom 5 1 Average 4 0 3 -1 UK 2 consensus 2016 2017 forecast Apr 2016 2.0% 2.1% 1 -2 Dec 2016 2.0% 1.2% % change 0.0% -0.9% 0 -3 -1 '00 '02 '04 '06 '08 '10 '12 '14 '16 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Left) FactSet, ONS, Bloomberg, J.P. Morgan Asset Management. Consensus forecasts are the Bloomberg contributor composite. (Right) FactSet, ONS, J.P. Morgan Asset Management. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food and energy. Guide to the Markets - UK. Data as of 31 December 2016. 4

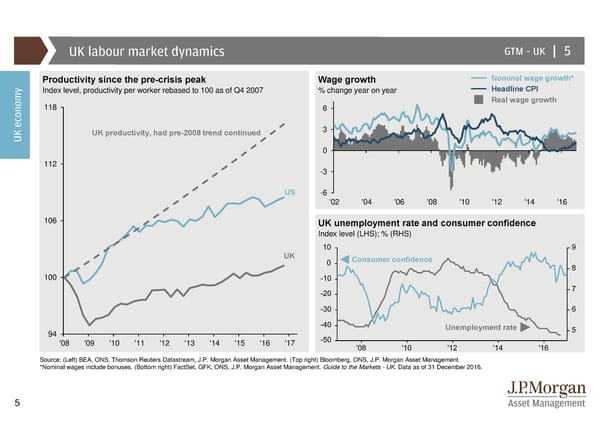

UK labour market dynamics GTM –UK | 5 Productivity since the pre-crisis peak Wage growth Nominal wage growth* y Index level, productivity per worker rebased to 100 as of Q4 2007 % change year on year Headline CPI 118 6 Real wage growth UK econom UK productivity, had pre-2008 trend continued 3 0 112 -3 US -6 '02 '04 '06 '08 '10 '12 '14 '16 106 UK unemployment rate and consumer confidence Index level (LHS); % (RHS) UK Consumer confidence 100 94 Unemployment rate '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Source: (Left) BEA, ONS, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Top right) Bloomberg, ONS, J.P. Morgan Asset Management. *Nominal wages include bonuses. (Bottom right) FactSet, GFK, ONS, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 5

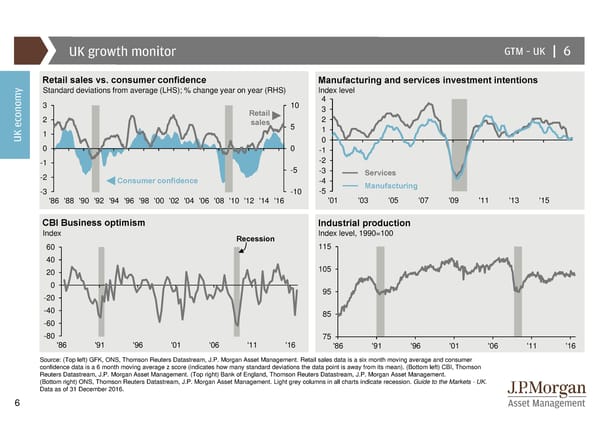

UK growth monitor GTM –UK | 6 y Retail sales vs. consumer confidence Manufacturing and services investment intentions Standard deviations from average (LHS); % change year on year (RHS) Index level 3 10 4 Retail 3 2 sales 5 2 UK econom1 1 0 0 0 -1 -1 -2 -2 -5 -3 Services Consumer confidence -4 Manufacturing -3 -10 -5 '86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 '01 '03 '05 '07 '09 '11 '13 '15 CBI Business optimism Industrial production Index Recession Index level, 1990=100 60 115 40 20 105 0 95 -20 -40 85 -60 -80 75 '86 '91 '96 '01 '06 '11 '16 '86 '91 '96 '01 '06 '11 '16 Source: (Top left) GFK, ONS, Thomson Reuters Datastream, J.P. Morgan Asset Management. Retail sales data is a six month moving average and consumer confidence data is a 6 month moving average z score (indicates how many standard deviations the data point is away from its mean). (Bottom left) CBI, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Top right) Bank of England, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom right) ONS, Thomson Reuters Datastream, J.P. Morgan Asset Management. Light grey columns in all charts indicate recession. Guide to the Markets - UK. Data as of 31 December 2016. 6

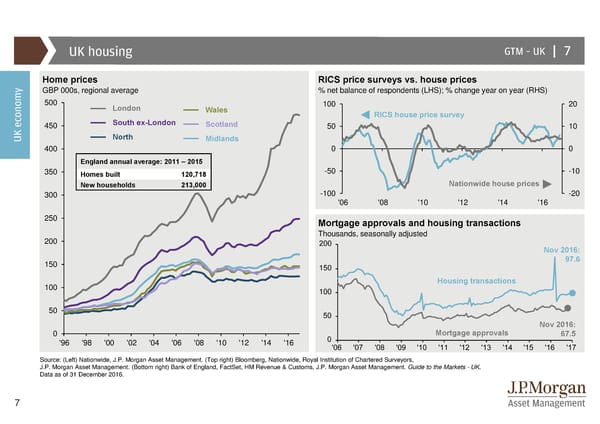

UK housing GTM –UK | 7 y Home prices RICS price surveys vs. house prices GBP 000s, regional average % net balance of respondents (LHS); % change year on year (RHS) 500 London Wales 100 20 South ex-London RICS house price survey 450 Scotland 50 10 UK econom North Midlands 400 0 0 England annual average: 2011 – 2015 350 Homes built 120,718 -50 -10 New households 213,000 Nationwide house prices 300 -100 -20 '06 '08 '10 '12 '14 '16 250 Mortgage approvals and housing transactions 200 Thousands, seasonally adjusted Nov 2016: 150 97.6 100 Housing transactions 50 Nov 2016: 0 Mortgage approvals 67.5 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Left) Nationwide, J.P. Morgan Asset Management. (Top right) Bloomberg, Nationwide, Royal Institution of Chartered Surveyors, J.P. Morgan Asset Management. (Bottom right) Bank of England, FactSet, HM Revenue & Customs, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 7

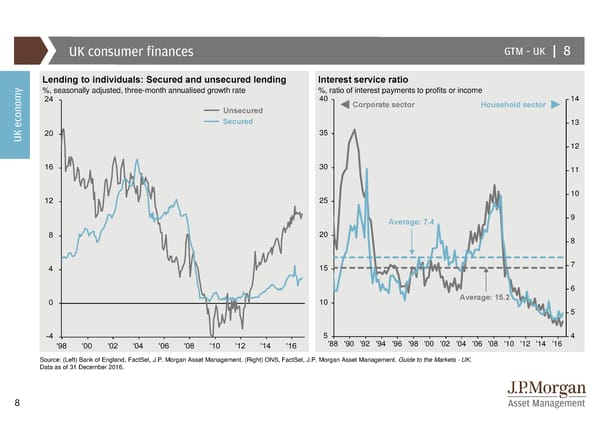

UK consumer finances GTM –UK | 8 y Lending to individuals: Secured and unsecured lending Interest service ratio %, seasonally adjusted, three-month annualised growth rate %, ratio of interest payments to profits or income 40 Corporate sector Household sector 14 Unsecured Secured 13 UK econom 35 12 30 11 25 10 Average: 7.4 9 20 8 15 7 6 10 Average: 15.2 5 5 4 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Left) Bank of England, FactSet, J.P. Morgan Asset Management. (Right) ONS, FactSet, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 8

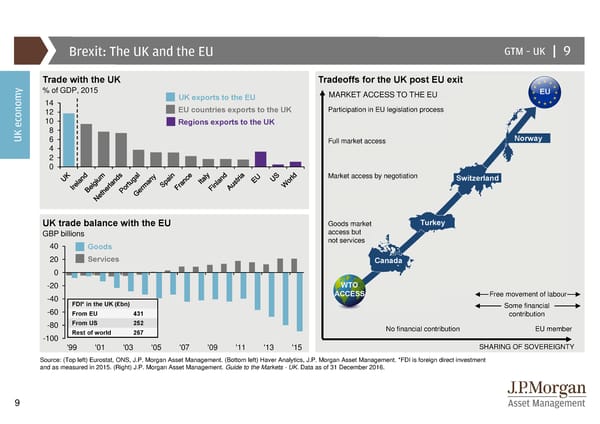

Brexit: The UK and the EU GTM –UK || 9 y Trade with the UK Tradeoffs for the UK post EU exit % of GDP, 2015 UK exports to the EU MARKET ACCESS TO THE EU EU 14 EU countries exports to the UK Participation in EU legislation process 12 10 Regions exports to the UK 8 UK econom6 Full market access Norway 4 2 0 Market access by negotiation Switzerland UK trade balance with the EU Goods market Turkey GBP billions access but 40 Goods not services 20 Services Canada 0 -20 WTO -40 ACCESS Free movement of labour -60 FDI* in the UK (£bn) Some financial From EU 431 contribution -80 From US 252 No financial contribution EU member -100 Rest of world 267 '99 '01 '03 '05 '07 '09 '11 '13 '15 SHARING OF SOVEREIGNTY Source: (Top left) Eurostat, ONS, J.P. Morgan Asset Management. (Bottom left) Haver Analytics, J.P. Morgan Asset Management. *FDI is foreign direct investment and as measured in 2015. (Right) J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 9

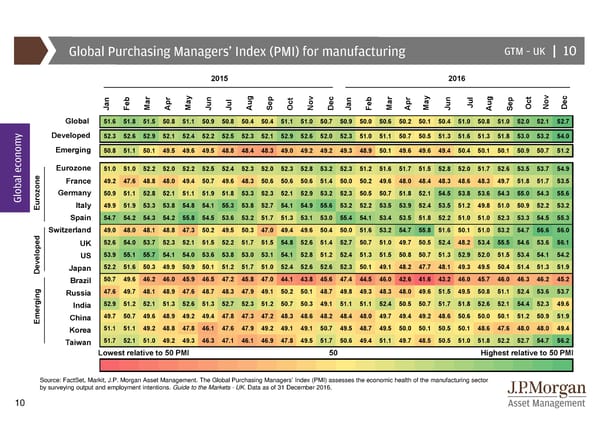

Global Purchasing Managers Index (PMI) for manufacturing GTM–UK | 10 2015 2016 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Global 51.6 51.8 51.5 50.8 51.1 50.9 50.8 50.4 50.4 51.1 51.0 50.7 50.9 50.0 50.6 50.2 50.1 50.4 51.0 50.8 51.0 52.0 52.1 52.7 y Developed 52.3 52.6 52.9 52.1 52.4 52.2 52.5 52.3 52.1 52.9 52.6 52.0 52.3 51.0 51.1 50.7 50.5 51.3 51.6 51.3 51.8 53.0 53.2 54.0 Emerging 50.8 51.1 50.1 49.5 49.6 49.5 48.8 48.4 48.3 49.0 49.2 49.2 49.3 48.9 50.1 49.6 49.6 49.4 50.4 50.1 50.1 50.9 50.7 51.2 Eurozone 51.0 51.0 52.2 52.0 52.2 52.5 52.4 52.3 52.0 52.3 52.8 53.2 52.3 51.2 51.6 51.7 51.5 52.8 52.0 51.7 52.6 53.5 53.7 54.9 France 49.2 47.6 48.8 48.0 49.4 50.7 49.6 48.3 50.6 50.6 50.6 51.4 50.0 50.2 49.6 48.0 48.4 48.3 48.6 48.3 49.7 51.8 51.7 53.5 Global economGermany 50.9 51.1 52.8 52.1 51.1 51.9 51.8 53.3 52.3 52.1 52.9 53.2 52.3 50.5 50.7 51.8 52.1 54.5 53.8 53.6 54.3 55.0 54.3 55.6 Eurozone Italy 49.9 51.9 53.3 53.8 54.8 54.1 55.3 53.8 52.7 54.1 54.9 55.6 53.2 52.2 53.5 53.9 52.4 53.5 51.2 49.8 51.0 50.9 52.2 53.2 Spain 54.7 54.2 54.3 54.2 55.8 54.5 53.6 53.2 51.7 51.3 53.1 53.0 55.4 54.1 53.4 53.5 51.8 52.2 51.0 51.0 52.3 53.3 54.5 55.3 d Switzerland 49.0 48.0 48.1 48.8 47.3 50.2 49.5 50.3 47.0 49.4 49.6 50.4 50.0 51.6 53.2 54.7 55.8 51.6 50.1 51.0 53.2 54.7 56.6 56.0 UK 52.6 54.0 53.7 52.3 52.1 51.5 52.2 51.7 51.5 54.8 52.6 51.4 52.7 50.7 51.0 49.7 50.5 52.4 48.2 53.4 55.5 54.6 53.6 56.1 US 53.9 55.1 55.7 54.1 54.0 53.6 53.8 53.0 53.1 54.1 52.8 51.2 52.4 51.3 51.5 50.8 50.7 51.3 52.9 52.0 51.5 53.4 54.1 54.2 Develope Japan 52.2 51.6 50.3 49.9 50.9 50.1 51.2 51.7 51.0 52.4 52.6 52.6 52.3 50.1 49.1 48.2 47.7 48.1 49.3 49.5 50.4 51.4 51.3 51.9 Brazil 50.7 49.6 46.2 46.0 45.9 46.5 47.2 45.8 47.0 44.1 43.8 45.6 47.4 44.5 46.0 42.6 41.6 43.2 46.0 45.7 46.0 46.3 46.2 45.2 Russia 47.6 49.7 48.1 48.9 47.6 48.7 48.3 47.9 49.1 50.2 50.1 48.7 49.8 49.3 48.3 48.0 49.6 51.5 49.5 50.8 51.1 52.4 53.6 53.7 India 52.9 51.2 52.1 51.3 52.6 51.3 52.7 52.3 51.2 50.7 50.3 49.1 51.1 51.1 52.4 50.5 50.7 51.7 51.8 52.6 52.1 54.4 52.3 49.6 Emerging China 49.7 50.7 49.6 48.9 49.2 49.4 47.8 47.3 47.2 48.3 48.6 48.2 48.4 48.0 49.7 49.4 49.2 48.6 50.6 50.0 50.1 51.2 50.9 51.9 Korea 51.1 51.1 49.2 48.8 47.8 46.1 47.6 47.9 49.2 49.1 49.1 50.7 49.5 48.7 49.5 50.0 50.1 50.5 50.1 48.6 47.6 48.0 48.0 49.4 Taiwan 51.7 52.1 51.0 49.2 49.3 46.3 47.1 46.1 46.9 47.8 49.5 51.7 50.6 49.4 51.1 49.7 48.5 50.5 51.0 51.8 52.2 52.7 54.7 56.2 Lowest relative to 50 PMI 50 Highest relative to 50 PMI Source: FactSet, Markit, J.P. Morgan Asset Management. The Global Purchasing Managers’ Index (PMI) assesses the economic health of the manufacturing sector by surveying output and employment intentions. Guide to the Markets - UK. Data as of 31 December 2016. 10

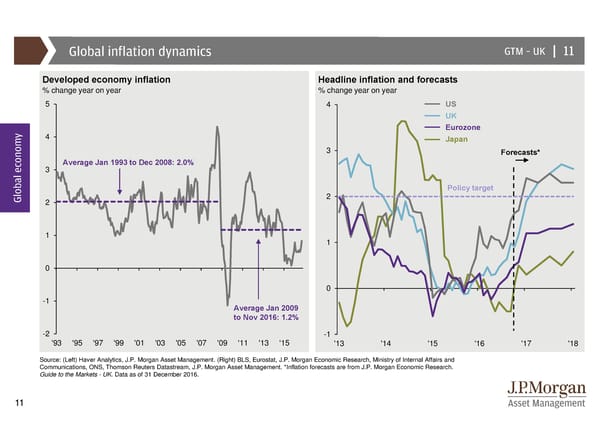

Global inflation dynamics GTM –UK | 11 Developed economy inflation Headline inflation and forecasts % change year on year % change year on year 5 4 US UK y Eurozone 4 Japan 3 Forecasts* 3 Average Jan 1993 to Dec 2008: 2.0% Policy target Global econom2 2 1 1 0 0 -1 Average Jan 2009 to Nov 2016: 1.2% -2 -1 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 '13 '14 '15 '16 '17 '18 Source: (Left) Haver Analytics, J.P. Morgan Asset Management. (Right) BLS, Eurostat, J.P. Morgan Economic Research, Ministry of Internal Affairs and Communications, ONS, Thomson Reuters Datastream, J.P. Morgan Asset Management. *Inflation forecasts are from J.P. Morgan Economic Research. Guide to the Markets - UK. Data as of 31 December 2016. 11

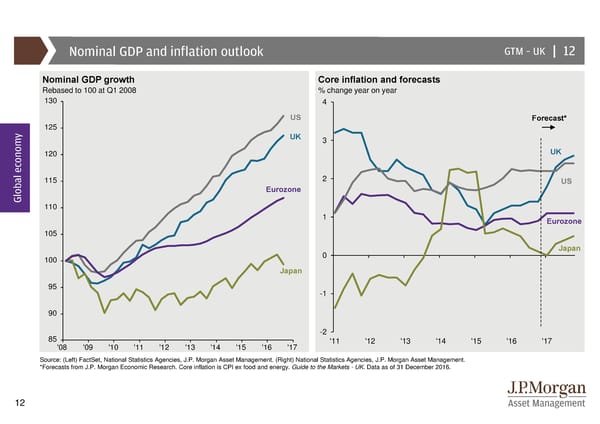

Nominal GDP and inflation outlook GTM –UK | 12 Nominal GDP growth Core inflation and forecasts Rebased to 100 at Q1 2008 % change year on year 130 4 US Forecast* y 125 UK 3 120 UK 115 2 US Global econom Eurozone 110 1 Eurozone 105 0 Japan 100 Japan 95 -1 90 85 -2 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '11 '12 '13 '14 '15 '16 '17 Source: (Left) FactSet, National Statistics Agencies, J.P. Morgan Asset Management. (Right) National Statistics Agencies, J.P. Morgan Asset Management. *Forecasts from J.P. Morgan Economic Research. Core inflation is CPI ex food and energy. Guide to the Markets - UK. Data as of 31 December 2016. 12

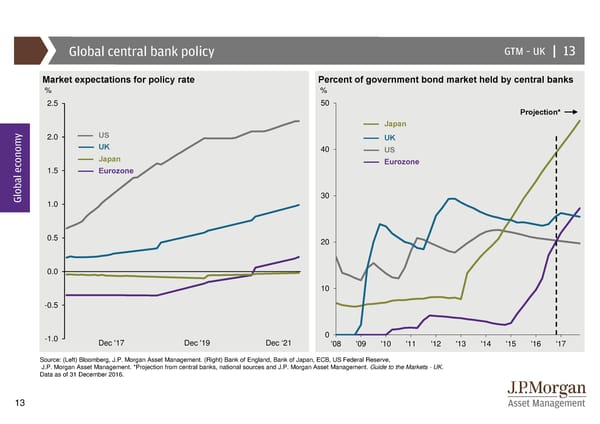

Global central bank policy GTM –UK | 13 Market expectations for policy rate Percent of government bond market held by central banks % % 2.5 50 Projection* Japan y 2.0 US UK UK 40 US Japan Eurozone 1.5 Eurozone Global econom 30 1.0 0.5 20 0.0 10 -0.5 -1.0 0 Dec '17 Dec '19 Dec ‘21 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Source: (Left) Bloomberg, J.P. Morgan Asset Management. (Right) Bank of England, Bank of Japan, ECB, US Federal Reserve, J.P. Morgan Asset Management. *Projection from central banks, national sources and J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 13

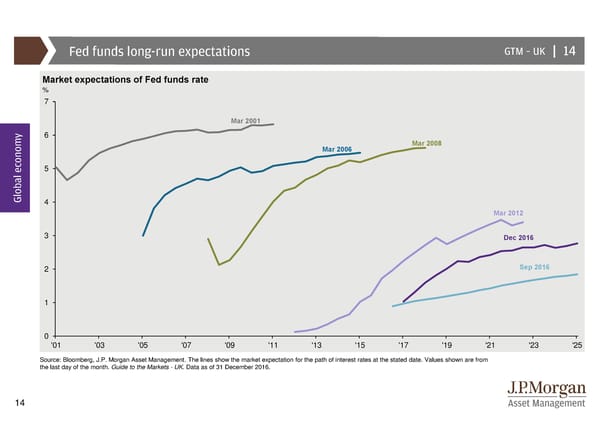

Fed funds long-run expectations GTM –UK | 14 Market expectations of Fed funds rate % 7 Mar 2001 y 6 Mar 2006 Mar 2008 5 Global econom4 Mar 2012 3 Dec 2016 2 Sep 2016 1 0 '01 '03 '05 '07 '09 '11 '13 '15 '17 '19 '21 '23 '25 Source: Bloomberg, J.P. Morgan Asset Management. The lines show the market expectation for the path of interest rates at the stated date. Values shown are from the last day of the month. Guide to the Markets - UK. Data as of 31 December 2016. 14

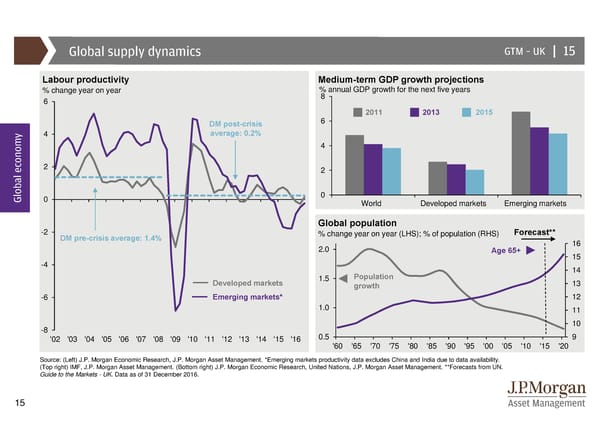

Global supply dynamics GTM –UK | 15 Labour productivity Medium-term GDP growth projections % change year on year % annual GDP growth for the next five years 6 8 2011 2013 2015 DM post-crisis 6 y 4 average: 0.2% 4 2 2 Global econom0 0 World Developed markets Emerging markets -2 Global population Forecast** DM pre-crisis average: 1.4% % change year on year (LHS); % of population (RHS) 2.0 Age 65+ 16 15 -4 14 Developed markets 1.5 Population 13 growth -6 Emerging markets* 12 1.0 11 -8 10 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 0.5 9 '60 '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 '20 Source: (Left) J.P. Morgan Economic Research, J.P. Morgan Asset Management. *Emerging markets productivity data excludes China and India due to data availability. (Top right) IMF, J.P. Morgan Asset Management. (Bottom right) J.P. Morgan Economic Research, United Nations, J.P. Morgan Asset Management. **Forecasts from UN. Guide to the Markets - UK. Data as of 31 December 2016. 15

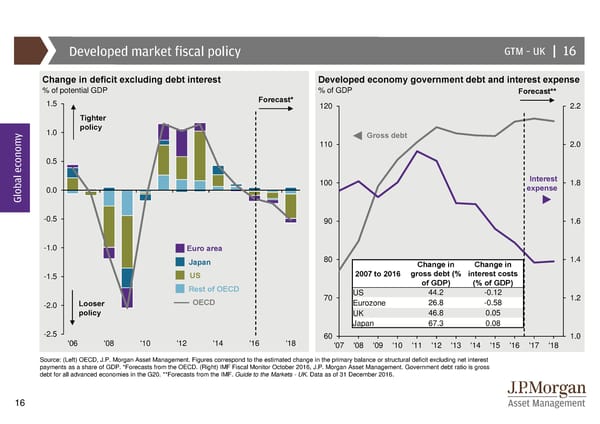

Developed market fiscal policy GTM –UK | 16 Change in deficit excluding debt interest Developed economy government debt and interest expense % of potential GDP % of GDP Forecast** 1.5 Forecast* 120 2.2 Tighter 1.0 policy y Gross debt 110 2.0 0.5 100 Interest 1.8 Global econom0.0 expense -0.5 90 1.6 -1.0 Euro area Japan 80 Change in Change in 1.4 -1.5 US 2007 to 2016 gross debt (% interest costs Rest of OECD of GDP) (% of GDP) 70 US 44.2 -0.12 1.2 -2.0 Looser OECD Eurozone 26.8 -0.58 policy UK 46.8 0.05 Japan 67.3 0.08 -2.5 60 1.0 '06 '08 '10 '12 '14 '16 '18 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 Source: (Left) OECD, J.P. Morgan Asset Management. Figures correspond to the estimated change in the primary balance or structural deficit excluding net interest payments as a share of GDP. *Forecasts from the OECD. (Right) IMF Fiscal Monitor October 2016, J.P. Morgan Asset Management. Government debt ratio is gross debt for all advanced economies in the G20. **Forecasts from the IMF. Guide to the Markets - UK. Data as of 31 December 2016. 16

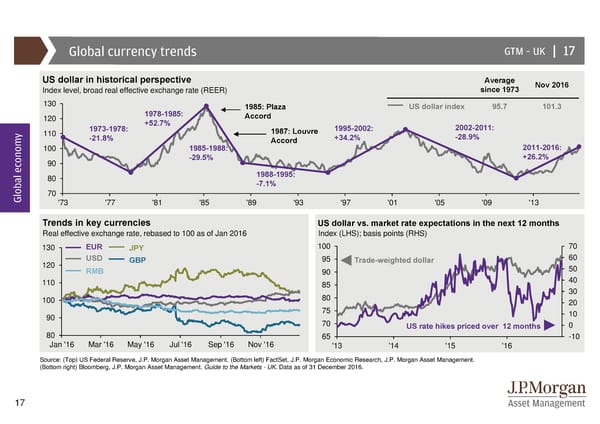

Global currency trends GTM –UK | 17 US dollar in historical perspective Average Nov 2016 Index level, broad real effective exchange rate (REER) since 1973 130 1985: Plaza US dollar index 95.7 101.3 120 1978-1985: Accord 1973-1978: +52.7% 1995-2002: 2002-2011: y 110 -21.8% 1987: Louvre +34.2% -28.9% 100 1985-1988: Accord 2011-2016: 90 -29.5% +26.2% 80 1988-1995: -7.1% Global econom70 '73 '77 '81 '85 '89 '93 '97 '01 '05 '09 '13 Trends in key currencies US dollar vs. market rate expectations in the next 12 months Real effective exchange rate, rebased to 100 as of Jan 2016 Index (LHS); basis points (RHS) 130 EUR JPY 100 70 120 USD GBP 95 Trade-weighted dollar 60 RMB 90 50 110 85 40 80 30 100 20 90 75 10 70 US rate hikes priced over 12 months 0 80 65 -10 Jan '16 Mar '16 May '16 Jul '16 Sep '16 Nov '16 '13 '14 '15 '16 Source: (Top) US Federal Reserve, J.P. Morgan Asset Management. (Bottom left) FactSet, J.P. Morgan Economic Research, J.P. Morgan Asset Management. (Bottom right) Bloomberg, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 17

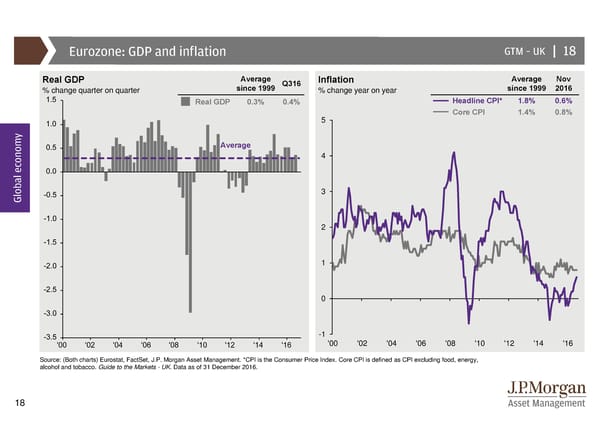

Eurozone: GDP and inflation GTM –UK | 18 Real GDP Average Q316 Inflation Average Nov % change quarter on quarter since 1999 % change year on year since 1999 2016 Real GDP 0.3% 0.4% Headline CPI* 1.8% 0.6% 5 Core CPI 1.4% 0.8% y Average 4 Global econom 3 2 1 0 -1 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Both charts) Eurostat, FactSet, J.P. Morgan Asset Management. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food, energy, alcohol and tobacco. Guide to the Markets - UK. Data as of 31 December 2016. 18

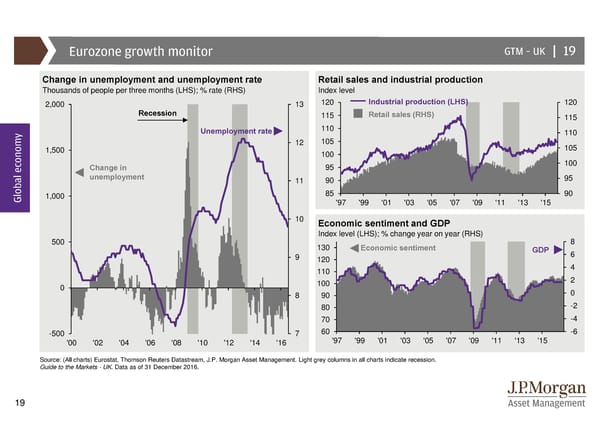

Eurozone growth monitor GTM –UK | 19 Change in unemployment and unemployment rate Retail sales and industrial production Thousands of people per three months (LHS); % rate (RHS) Index level 2,000 13 120 Industrial production (LHS) 120 Recession 115 Retail sales (RHS) 115 y Unemploymentrate 110 110 12 105 105 1,500 100 Change in 95 100 unemployment 11 90 95 Global econom1,000 85 90 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 10 Economic sentiment and GDP Index level (LHS); % change year on year (RHS) 8 500 130 Economic sentiment 9 GDP 6 120 4 110 0 100 2 8 90 0 80 -2 70 -4 -500 7 60 -6 '00 '02 '04 '06 '08 '10 '12 '14 '16 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 Source: (All charts) Eurostat, Thomson Reuters Datastream, J.P. Morgan Asset Management. Light grey columns in all charts indicate recession. Guide to the Markets - UK. Data as of 31 December 2016. 19

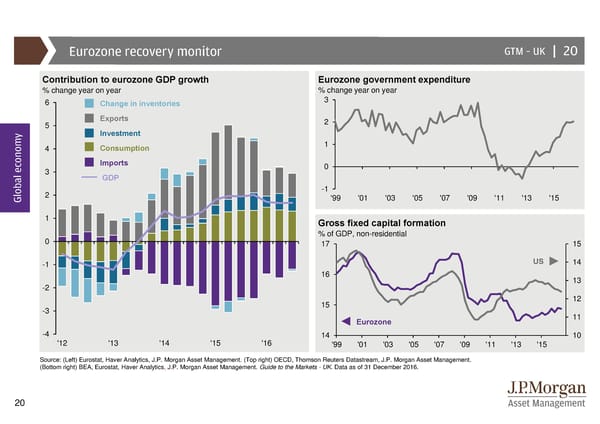

Eurozone recovery monitor GTM –UK | 20 Contribution to eurozone GDP growth Eurozone government expenditure % change year on year % change year on year 6 Change in inventories 3 5 Exports 2 y Investment 4 Consumption 1 Imports 0 3 GDP 2 -1 Global econom '99 '01 '03 '05 '07 '09 '11 '13 '15 1 Gross fixed capital formation 0 % of GDP, non-residential 17 15 -1 US 14 16 13 -2 15 12 -3 11 Eurozone -4 14 10 '12 '13 '14 '15 '16 '99 '01 '03 '05 '07 '09 '11 '13 '15 Source: (Left) Eurostat, Haver Analytics, J.P. Morgan Asset Management. (Top right) OECD, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom right) BEA, Eurostat, Haver Analytics, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 20

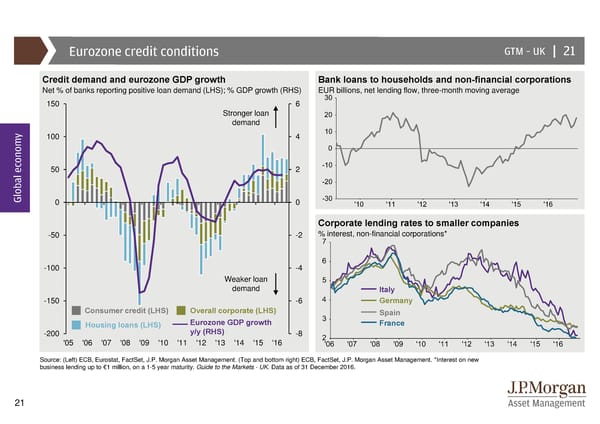

Eurozone credit conditions GTM –UK | 21 Credit demand and eurozone GDP growth Bank loans to households and non-financial corporations Net % of banks reporting positive loan demand (LHS); % GDP growth (RHS) EUR billions, net lending flow, three-month moving average 150 6 Stronger loan demand y 100 4 50 2 Global econom0 0 Corporate lending rates to smaller companies -50 -2 % interest, non-financial corporations* -100 -4 Weaker loan demand Italy -150 -6 Germany Consumer credit (LHS) Overall corporate (LHS) Spain Housing loans (LHS) Eurozone GDP growth France -200 y/y (RHS) -8 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: (Left) ECB, Eurostat, FactSet, J.P. Morgan Asset Management. (Top and bottom right) ECB, FactSet, J.P. Morgan Asset Management. *Interest on new business lending up to €1 million, on a 1-5 year maturity. Guide to the Markets - UK. Data as of 31 December 2016. 21

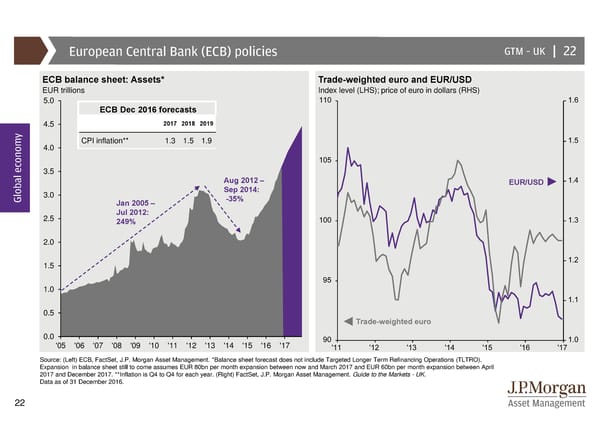

European Central Bank (ECB) policies GTM –UK | 22 ECB balance sheet: Assets* Trade-weighted euro and EUR/USD EUR trillions Index level (LHS); price of euro in dollars (RHS) 5.0 ECB Dec2016 forecasts y 4.5 2017 2018 2019 4.0 CPIinflation** 1.3 1.5 1.9 3.5 Aug2012 – EUR/USD 3.0 Sep 2014: Global econom Jan 2005 – -35% 2.5 Jul 2012: 249% 2.0 1.5 1.0 0.5 Trade-weighted euro 0.0 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Source: (Left) ECB, FactSet, J.P. Morgan Asset Management. *Balance sheet forecast does not include Targeted Longer Term Refinancing Operations (TLTRO). Expansion in balance sheet still to come assumes EUR 80bn per month expansion between now and March 2017 and EUR 60bn per month expansion between April 2017 and December 2017. **Inflation is Q4 to Q4 for each year. (Right) FactSet, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 22

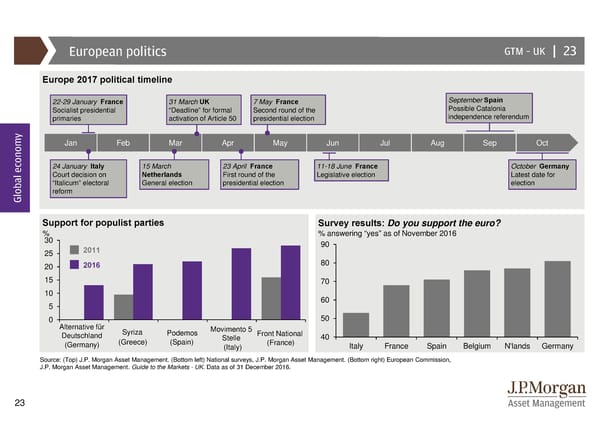

European politics GTM –UK | 23 Europe 2017 political timeline 22-29 January France 31 March UK 7 May France September Spain Socialist presidential “Deadline” for formal Second round of the Possible Catalonia primaries activation of Article 50 presidential election independence referendum y Jan Feb Mar Apr May Jun Jul Aug Sep Oct 24 January Italy 15 March 23 April France 11-18 June France October Germany Court decision on Netherlands First round of the Legislative election Latest date for “Italicum” electoral General election presidential election election Global economreform Support for populist parties Survey results: Do you support the euro? % % answering “yes” as of November 2016 30 90 25 2011 20 2016 80 15 70 10 60 5 0 50 Alternative für Syriza Podemos Movimento5 Front National Deutschland (Greece) (Spain) Stelle (France) 40 (Germany) (Italy) Italy France Spain Belgium N'lands Germany Source: (Top) J.P. Morgan Asset Management. (Bottom left) National surveys, J.P. Morgan Asset Management. (Bottom right) European Commission, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 23

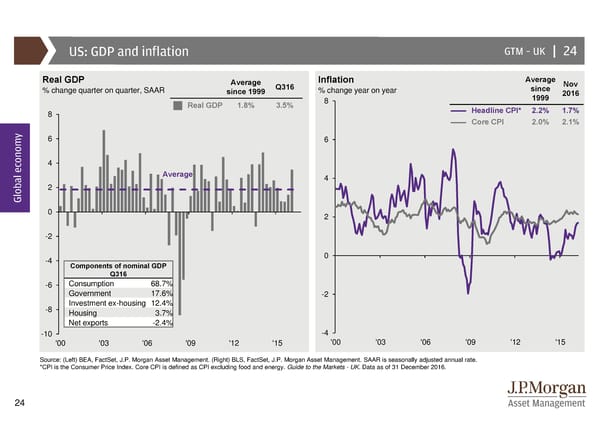

US: GDP and inflation GTM –UK | 24 Real GDP Average Q316 Inflation Average Nov % change quarter on quarter, SAAR since 1999 % change year on year since 2016 Real GDP 1.8% 3.5% 8 1999 8 HeadlineCPI* 2.2% 1.7% Core CPI 2.0% 2.1% y 6 6 4 Average 4 2 Global econom 0 2 -2 -4 0 Componentsof nominal GDP Q316 -6 Consumption 68.7% Government 17.6% -2 -8 Investment ex-housing 12.4% Housing 3.7% Net exports -2.4% -10 -4 '00 '03 '06 '09 '12 '15 '00 '03 '06 '09 '12 '15 Source: (Left) BEA, FactSet, J.P. Morgan Asset Management. (Right) BLS, FactSet, J.P. Morgan Asset Management. SAAR is seasonally adjusted annual rate. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food and energy. Guide to the Markets - UK. Data as of 31 December 2016. 24

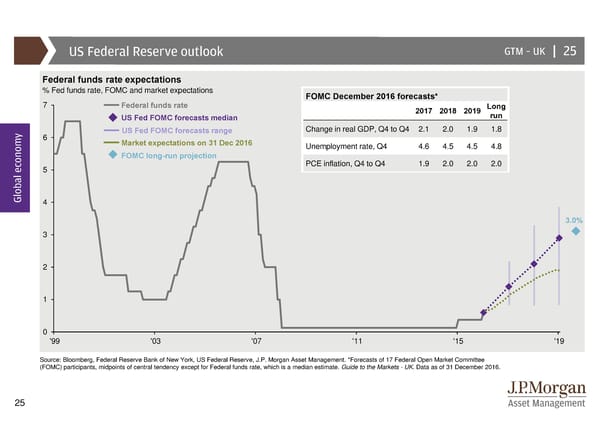

US Federal Reserve outlook GTM –UK | 25 Federal funds rate expectations % Fed funds rate, FOMC and market expectations FOMC December 2016 forecasts* 7 Federal funds rate 2017 2018 2019 Long US Fed FOMC forecasts median run y US Fed FOMC forecasts range Change in real GDP, Q4 to Q4 2.1 2.0 1.9 1.8 6 Market expectations on 31 Dec 2016 Unemployment rate, Q4 4.6 4.5 4.5 4.8 FOMC long-run projection PCE inflation, Q4 to Q4 1.9 2.0 2.0 2.0 5 Global econom4 3.0% 3 2 1 0 '99 '03 '07 '11 '15 '19 Source: Bloomberg, Federal Reserve Bank of New York, US Federal Reserve, J.P. Morgan Asset Management. *Forecasts of 17 Federal Open Market Committee (FOMC) participants, midpoints of central tendency except for Federal funds rate, which is a median estimate. Guide to the Markets - UK. Data as of 31 December 2016. 25

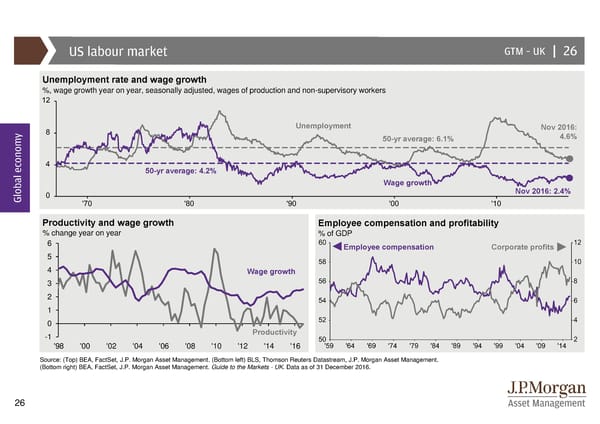

US labour market GTM –UK | 26 Unemployment rate and wage growth %, wage growth year on year, seasonally adjusted, wages of production and non-supervisory workers y Unemployment Nov 2016: 50-yr average: 6.1% 4.6% 50-yr average: 4.2% Wage growth Global econom Nov 2016: 2.4% Productivity and wage growth Employee compensation and profitability % change year on year % of GDP 6 Employee compensation Corporate profits 5 4 Wage growth 3 2 1 0 -1 Productivity '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Top) BEA, FactSet, J.P. Morgan Asset Management. (Bottom left) BLS, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom right) BEA, FactSet, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 26

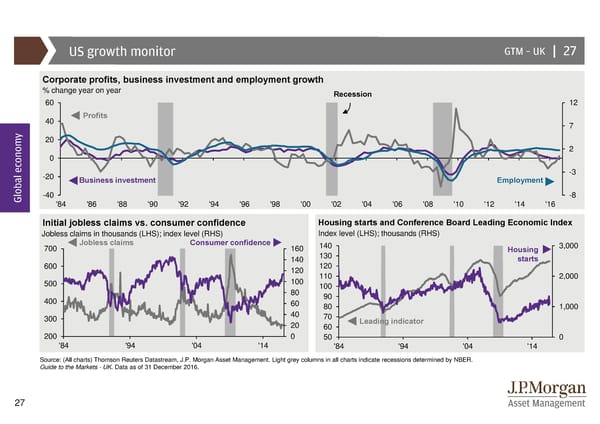

US growth monitor GTM –UK | 27 Corporate profits, business investment and employment growth % change year on year Recession 60 12 40 Profits y 7 20 2 0 -20 -3 Business investment Employment Global econom-40 -8 '84 '86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Initial jobless claims vs. consumer confidence Housing starts and Conference Board Leading Economic Index Jobless claims in thousands (LHS); index level (RHS) Index level (LHS); thousands (RHS) 700 Jobless claims Consumer confidence 160 140 Housing 3,000 140 130 starts 600 120 120 500 100 110 2,000 80 100 400 60 90 40 80 1,000 300 70 Leading indicator 20 60 200 0 50 0 '84 '94 '04 '14 '84 '94 '04 '14 Source: (All charts) Thomson Reuters Datastream, J.P. Morgan Asset Management. Light grey columns in all charts indicate recessions determined by NBER. Guide to the Markets - UK. Data as of 31 December 2016. 27

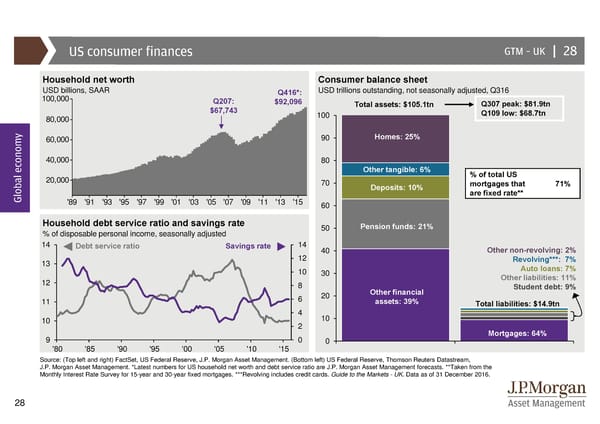

US consumer finances GTM –UK | 28 Household net worth Consumer balance sheet USD billions, SAAR Q416*: USD trillions outstanding, not seasonally adjusted, Q316 100,000 Q207: $92,096 Total assets: $105.1tn Q307 peak: $81.9tn $67,743 100 Q109 low: $68.7tn 80,000 y 60,000 90 Homes: 25% 40,000 80 Other tangible: 6% % of total US 20,000 70 mortgages that 71% Global econom Deposits: 10% are fixed rate** '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 60 Household debt service ratio and savings rate 50 Pension funds: 21% % of disposable personal income, seasonally adjusted 14 Debt service ratio Savings rate 14 40 Other non-revolving: 2% 13 12 Revolving***: 7% 10 30 Auto loans: 7% 12 8 Other liabilities: 11% Other financial Student debt: 9% 11 6 20 assets: 39% Total liabilities: $14.9tn 4 10 10 2 9 0 0 Mortgages: 64% '80 '85 '90 '95 '00 '05 '10 '15 Source: (Top left and right) FactSet, US Federal Reserve, J.P. Morgan Asset Management. (Bottom left) US Federal Reserve, Thomson Reuters Datastream, J.P. Morgan Asset Management. *Latest numbers for US household net worth and debt service ratio are J.P. Morgan Asset Management forecasts. **Taken from the Monthly Interest Rate Survey for 15-year and 30-year fixed mortgages. ***Revolving includes credit cards. Guide to the Markets - UK. Data as of 31 December 2016. 28

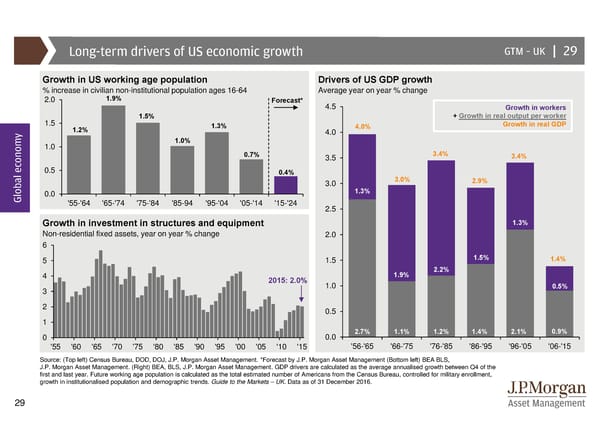

Long-term drivers of US economic growth GTM –UK | 29 Growth in US working age population Drivers of US GDP growth % increase in civilian non-institutional population ages 16-64 Average year on year % change 2.0 1.9% Forecast* 4.5 Growth in workers 1.5 1.5% + Growth in real output per worker y 1.2% 1.3% 4.0 4.0% Growth in real GDP 1.0 1.0% 0.7% 3.5 3.4% 3.4% 0.5 0.4% 3.0 3.0% 2.9% Global econom0.0 1.3% '55-'64 '65-'74 '75-'84 '85-94 '95-'04 '05-'14 '15-'24 2.5 Growth in investment in structures and equipment 1.3% Non-residential fixed assets, year on year % change 2.0 6 5 1.5 1.5% 1.4% 4 1.9% 2.2% 2015: 2.0% 1.0 0.5% 3 2 0.5 1 0 0.0 2.7% 1.1% 1.2% 1.4% 2.1% 0.9% '55 '60 '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 '56-'65 '66-'75 '76-'85 '86-'95 '96-'05 '06-'15 Source: (Top left) Census Bureau, DOD, DOJ, J.P. Morgan Asset Management. *Forecast by J.P. Morgan Asset Management (Bottom left) BEA BLS, J.P. Morgan Asset Management. (Right) BEA, BLS, J.P. Morgan Asset Management. GDP drivers are calculated as the average annualised growth between Q4 of the first and last year. Future working age population is calculated as the total estimated number of Americans from the Census Bureau, controlled for military enrollment, growth in institutionalised population and demographic trends. Guide to the Markets – UK. Data as of 31 December 2016. 29

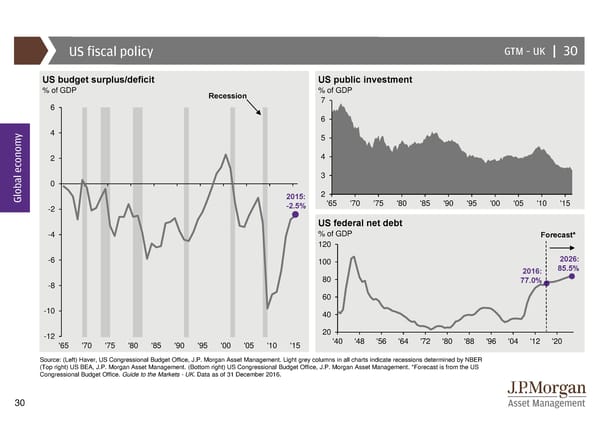

US fiscal policy GTM –UK | 30 US budget surplus/deficit US public investment % of GDP Recession % of GDP 6 7 6 y 4 5 2 4 3 0 Global econom 2015: 2 -2 -2.5% '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 US federal net debt -4 % of GDP Forecast* 120 -6 100 2026: 2016: 85.5% -8 80 77.0% 60 -10 40 -12 20 '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 '40 '48 '56 '64 '72 '80 '88 '96 '04 '12 '20 Source: (Left) Haver, US Congressional Budget Office, J.P. Morgan Asset Management. Light grey columns in all charts indicate recessions determined by NBER (Top right) US BEA, J.P. Morgan Asset Management. (Bottom right) US Congressional Budget Office, J.P. Morgan Asset Management. *Forecast is from the US Congressional Budget Office. Guide to the Markets - UK. Data as of 31 December 2016. 30

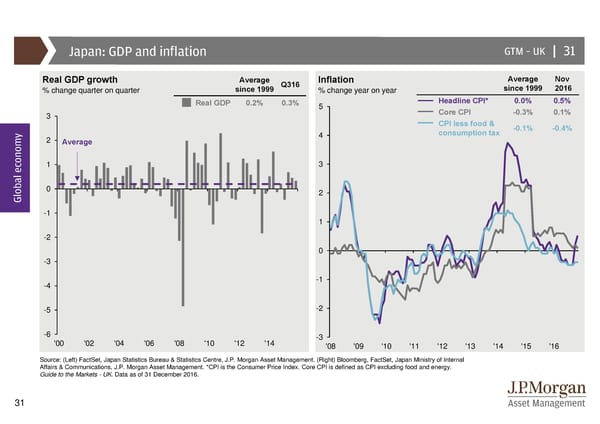

Japan: GDP and inflation GTM –UK | 31 Real GDP growth Average Q316 Inflation Average Nov % change quarter on quarter since 1999 % change year on year since 1999 2016 Real GDP 0.2% 0.3% 5 Headline CPI* 0.0% 0.5% 3 Core CPI -0.3% 0.1% CPI less food & -0.1% -0.4% y 2 4 consumption tax Average 1 3 Global econom0 2 -1 1 -2 0 -3 -4 -1 -5 -2 -6 -3 '00 '02 '04 '06 '08 '10 '12 '14 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: (Left) FactSet, Japan Statistics Bureau & Statistics Centre, J.P. Morgan Asset Management. (Right) Bloomberg, FactSet, Japan Ministry of Internal Affairs & Communications, J.P. Morgan Asset Management. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food and energy. Guide to the Markets - UK. Data as of 31 December 2016. 31

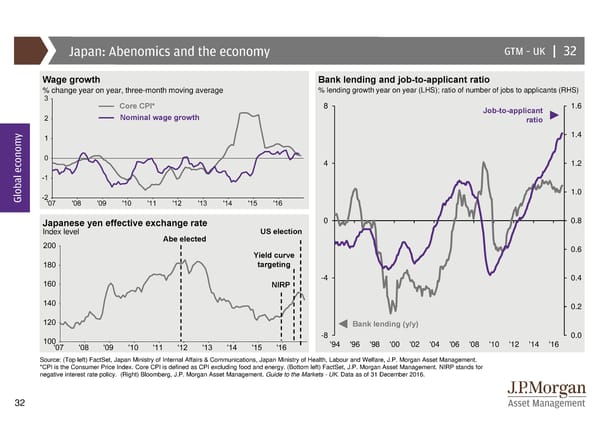

Japan: Abenomics and the economy GTM –UK | 32 Wage growth Bank lending and job-to-applicant ratio % change year on year, three-month moving average % lending growth year on year (LHS); ratio of number of jobs to applicants (RHS) Core CPI* 8 Job-to-applicant 1.6 Nominal wage growth ratio y 1.4 4 1.2 Global econom 1.0 Japanese yen effective exchange rate 0 0.8 Index level Abe elected US election Yield curve 0.6 targeting NIRP -4 0.4 0.2 Bank lending (y/y) -8 0.0 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Top left) FactSet, Japan Ministry of Internal Affairs & Communications, Japan Ministry of Health, Labour and Welfare, J.P. Morgan Asset Management. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food and energy. (Bottom left) FactSet, J.P. Morgan Asset Management. NIRP stands for negative interest rate policy. (Right) Bloomberg, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 32

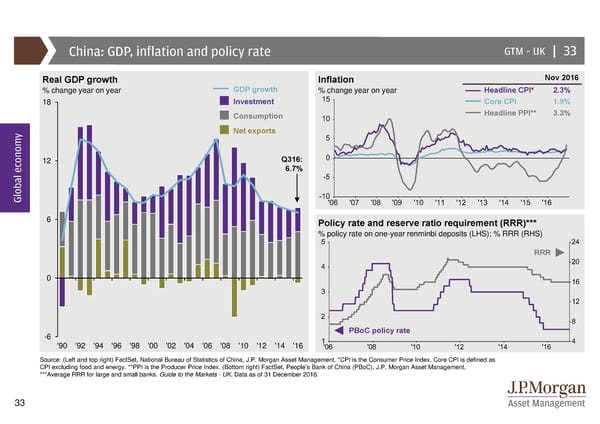

China: GDP, inflation and policy rate GTM –UK | 33 Real GDP growth Inflation Nov 2016 % change year on year GDP growth % change year on year Headline CPI* 2.3% 18 Investment CoreCPI 1.9% Consumption Headline PPI** 3.3% y Net exports 12 Q316: 6.7% Global econom 6 Policy rate and reserve ratio requirement (RRR)*** % policy rate on one-year renminbi deposits (LHS); % RRR (RHS) RRR 0 -6 PBoC policy rate '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Left and top right) FactSet, National Bureau of Statistics of China, J.P. Morgan Asset Management. *CPI is the Consumer Price Index. Core CPI is defined as CPI excluding food and energy. **PPI is the Producer Price Index. (Bottom right) FactSet, People’s Bank of China (PBoC), J.P. Morgan Asset Management. ***Average RRR for large and small banks. Guide to the Markets - UK. Data as of 31 December 2016. 33

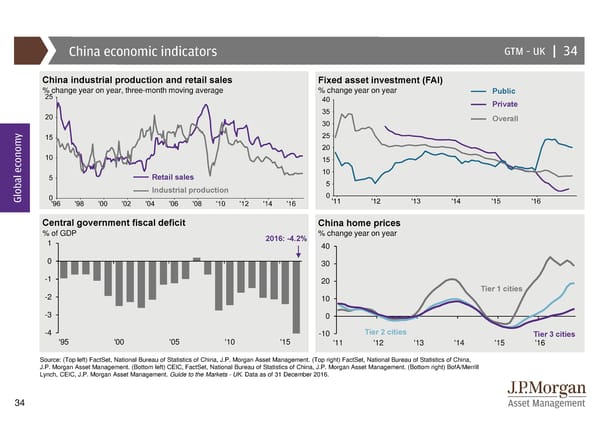

China economic indicators GTM –UK | 34 China industrial production and retail sales Fixed asset investment (FAI) % change year on year, three-month moving average % change year on year Public Private Overall y Retail sales Global econom Industrial production Central government fiscal deficit China home prices % of GDP 2016: -4.2% % change year on year 1 40 0 30 -1 20 -2 Tier 1 cities 10 -3 0 -4 -10 Tier 2 cities Tier 3 cities '95 '00 '05 '10 '15 '11 '12 '13 '14 '15 '16 Source: (Top left) FactSet, National Bureau of Statistics of China, J.P. Morgan Asset Management. (Top right) FactSet, National Bureau of Statistics of China, J.P. Morgan Asset Management. (Bottom left) CEIC, FactSet, National Bureau of Statistics of China, J.P. Morgan Asset Management. (Bottom right) BofA/Merrill Lynch, CEIC, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 34

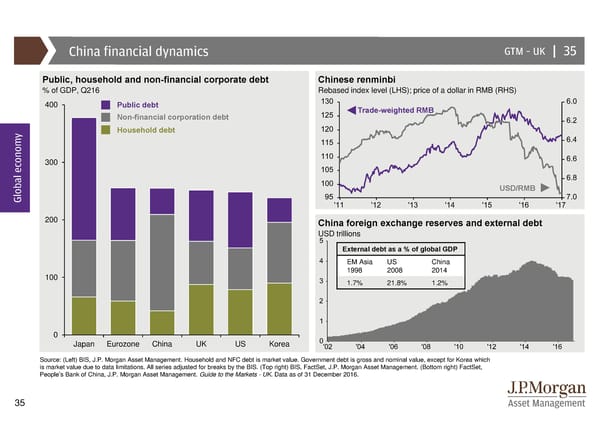

China financial dynamics GTM –UK | 35 Public, household and non-financial corporate debt Chinese renminbi % of GDP, Q216 Rebased index level (LHS); price of a dollar in RMB (RHS) 400 Public debt Trade-weightedRMB Non-financial corporation debt y Household debt 300 Global econom USD/RMB 200 China foreign exchange reserves and external debt USD trillions External debt as a % of global GDP EM Asia US China 100 1998 2008 2014 1.7% 21.8% 1.2% 0 Japan Eurozone China UK US Korea Source: (Left) BIS, J.P. Morgan Asset Management. Household and NFC debt is market value. Government debt is gross and nominal value, except for Korea which is market value due to data limitations. All series adjusted for breaks by the BIS. (Top right) BIS, FactSet, J.P. Morgan Asset Management. (Bottom right) FactSet, People’s Bank of China, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 35

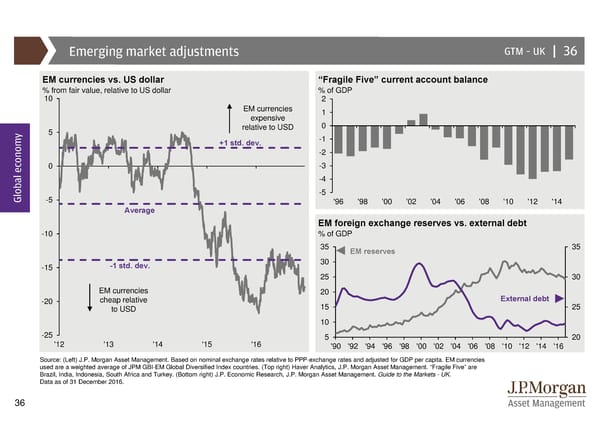

Emerging market adjustments GTM –UK | 36 EM currencies vs. US dollar “Fragile Five” current account balance % from fair value, relative to US dollar % of GDP 10 2 EM currencies 1 expensive 0 y 5 relative to USD +1 std. dev. -1 -2 0 -3 -4 Global econom-5 -5 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 Average EM foreign exchange reserves vs. external debt -10 % of GDP 35 EM reserves 35 -15 -1 std. dev. 30 25 30 EM currencies 20 -20 cheap relative 15 External debt 25 to USD 10 -25 5 20 '12 '13 '14 '15 '16 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: (Left) J.P. Morgan Asset Management. Based on nominal exchange rates relative to PPP-exchange rates and adjusted for GDP per capita. EM currencies used are a weighted average of JPM GBI-EM Global Diversified Index countries. (Top right) Haver Analytics, J.P. Morgan Asset Management. “Fragile Five” are Brazil, India, Indonesia, South Africa and Turkey. (Bottom right) J.P. Economic Research, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 36

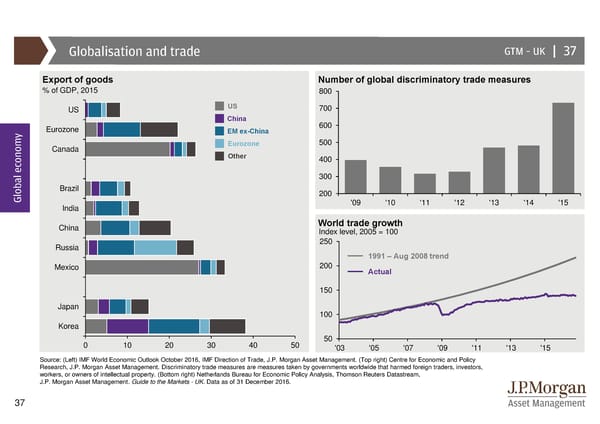

Globalisation and trade GTM –UK | 37 Export of goods Number of global discriminatory trade measures % of GDP, 2015 800 US US 700 China 600 y Eurozone EM ex-China Canada Eurozone 500 Other 400 300 Global economBrazil 200 India '09 '10 '11 '12 '13 '14 '15 China World trade growth Index level, 2005 = 100 Russia 250 1991 – Aug 2008 trend Mexico 200 Actual 150 Japan 100 Korea 50 01020304050'03 '05 '07 '09 '11 '13 '15 Source: (Left) IMF World Economic Outlook October 2016, IMF Direction of Trade, J.P. Morgan Asset Management. (Top right) Centre for Economic and Policy Research, J.P. Morgan Asset Management. Discriminatory trade measures are measures taken by governments worldwide that harmed foreign traders, investors, workers, or owners of intellectual property. (Bottom right) Netherlands Bureau for Economic Policy Analysis, Thomson Reuters Datastream, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 37

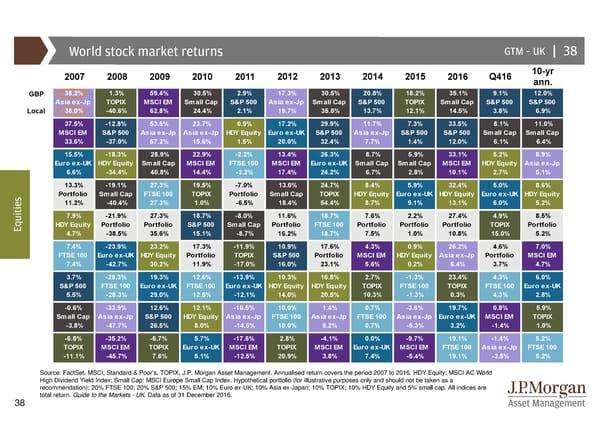

World stock market returns GTM–UK | 38 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q416 10-yr ann. GBP 38.2% 1.3% 59.4% 30.5% 2.9% 17.3% 30.5% 20.8% 18.2% 35.1% 9.1% 12.0% Asia ex-Jp TOPIX MSCI EM Small Cap S&P 500 Asia ex-Jp Small Cap S&P 500 TOPIX Small Cap S&P 500 S&P 500 Local 38.0% -40.6% 62.8% 24.4% 2.1% 19.7% 35.8% 13.7% 12.1% 14.5% 3.8% 6.9% 37.5% -12.8% 53.6% 23.7% 0.9% 17.2% 29.9% 11.7% 7.3% 33.5% 8.1% 11.0% MSCI EM S&P 500 Asia ex-Jp Asia ex-Jp HDY Equity Euro ex-UK S&P 500 Asia ex-Jp S&P 500 S&P 500 Small Cap Small Cap 33.6% -37.0% 67.2% 15.6% 1.5% 20.0% 32.4% 7.7% 1.4% 12.0% 6.1% 6.4% 15.5% -18.3% 28.9% 22.9% -2.2% 13.4% 26.3% 8.7% 5.9% 33.1% 5.2% 8.9% Euro ex-UK HDY Equity Small Cap MSCI EM FTSE 100 MSCI EM Euro ex-UK Small Cap Small Cap MSCI EM HDY Equity Asia ex-Jp 6.6% -34.4% 40.8% 14.4% -2.2% 17.4% 24.2% 6.7% 2.8% 10.1% 2.7% 5.1% 13.3% -19.1% 27.3% 19.5% -7.0% 13.0% 24.7% 8.4% 5.9% 32.4% 5.0% 8.6% s Portfolio Small Cap FTSE 100 TOPIX Portfolio Small Cap TOPIX HDY Equity Euro ex-UK HDY Equity Euro ex-UK HDY Equity e 11.2% -40.4% 27.3% 1.0% -6.5% 18.4% 54.4% 8.7% 9.1% 13.1% 6.0% 5.2% i t i 7.9% -21.9% 27.3% 18.7% -8.0% 11.6% 18.7% 7.6% 2.2% 27.4% 4.9% 8.5% u Eq HDY Equity Portfolio Portfolio S&P 500 Small Cap Portfolio FTSE 100 Portfolio Portfolio Portfolio TOPIX Portfolio 4.7% -38.5% 35.6% 15.1% -8.7% 16.2% 18.7% 7.5% 1.0% 10.8% 15.0% 5.2% 7.4% -23.9% 23.2% 17.3% -11.9% 10.9% 17.6% 4.3% 0.9% 26.2% 4.6% 7.0% FTSE 100 Euro ex-UK HDY Equity Portfolio TOPIX S&P 500 Portfolio MSCI EM HDY Equity Asia ex-Jp Portfolio MSCI EM 7.4% -42.7% 30.2% 11.9% -17.0% 16.0% 23.1% 5.6% 0.2% 6.4% 3.7% 4.7% 3.7% -28.3% 19.3% 12.6% -13.9% 10.3% 16.8% 2.7% -1.3% 23.4% 4.3% 6.0% S&P 500 FTSE 100 Euro ex-UK FTSE 100 Euro ex-UK HDY Equity HDY Equity TOPIX FTSE 100 TOPIX FTSE 100 Euro ex-UK 5.5% -28.3% 29.0% 12.6% -12.1% 14.0% 20.5% 10.3% -1.3% 0.3% 4.3% 2.8% -0.6% -33.9% 12.6% 12.1% -16.5% 10.0% 1.4% 0.7% -3.6% 19.7% 0.8% 5.9% Small Cap Asia ex-Jp S&P 500 HDY Equity Asia ex-Jp FTSE 100 Asia ex-Jp FTSE 100 Asia ex-Jp Euro ex-UK MSCI EM TOPIX -3.8% -47.7% 26.5% 8.0% -14.6% 10.0% 6.2% 0.7% -5.3% 3.2% -1.4% 1.0% -6.8% -35.2% -6.7% 5.7% -17.6% 2.8% -4.1% 0.0% -9.7% 19.1% -1.4% 5.2% TOPIX MSCI EM TOPIX Euro ex-UK MSCI EM TOPIX MSCI EM Euro ex-UK MSCI EM FTSE 100 Asia ex-Jp FTSE 100 -11.1% -45.7% 7.6% 5.1% -12.5% 20.9% 3.8% 7.4% -5.4% 19.1% -3.5% 5.2% Source: FactSet, MSCI, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. Annualised return covers the period 2007 to 2016. HDY Equity: MSCI AC World High Dividend Yield Index; Small Cap: MSCI Europe Small Cap Index. Hypothetical portfolio (for illustrative purposes only and should not be taken as a recommendation): 20% FTSE 100; 20% S&P 500; 15% EM; 10% Euro ex-UK; 10% Asia ex-Japan; 10% TOPIX; 10% HDY Equity and 5% small cap. All indices are total return. Guide to the Markets - UK. Data as of 31 December 2016. 38

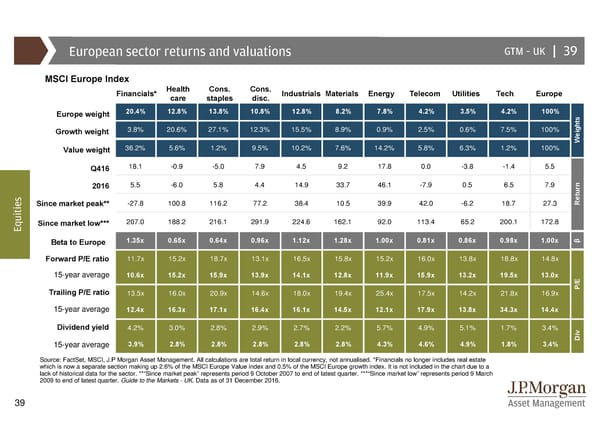

European sector returns and valuations GTM–UK | 39 MSCI Europe Index Financials* Health Cons. Cons. Industrials Materials Energy Telecom Utilities Tech Europe care staples disc. Europe weight 20.4% 12.8% 13.8% 10.8% 12.8% 8.2% 7.8% 4.2% 3.5% 4.2% 100% s t h 3.8% 20.6% 27.1% 12.3% 15.5% 8.9% 0.9% 2.5% 0.6% 7.5% 100% g Growth weight i We Value weight 36.2% 5.6% 1.2% 9.5% 10.2% 7.6% 14.2% 5.8% 6.3% 1.2% 100% Q416 18.1 -0.9 -5.0 7.9 4.5 9.2 17.8 0.0 -3.8 -1.4 5.5 2016 5.5 -6.0 5.8 4.4 14.9 33.7 46.1 -7.9 0.5 6.5 7.9 n r u s t e Since market peak** -27.8 100.8 116.2 77.2 38.4 10.5 39.9 42.0 -6.2 18.7 27.3 Re i t i u Since market low*** 207.0 188.2 216.1 291.9 224.6 162.1 92.0 113.4 65.2 200.1 172.8 Eq β Beta to Europe 1.35x 0.65x 0.64x 0.96x 1.12x 1.28x 1.00x 0.81x 0.86x 0.98x 1.00x Forward P/E ratio 11.7x 15.2x 18.7x 13.1x 16.5x 15.8x 15.2x 16.0x 13.8x 18.8x 14.8x 15-year average 10.6x 15.2x 15.9x 13.9x 14.1x 12.8x 11.9x 15.9x 13.2x 19.5x 13.0x E Trailing P/E ratio 13.5x 16.0x 20.9x 14.6x 18.0x 19.4x 25.4x 17.5x 14.2x 21.8x 16.9x P/ 15-year average 12.4x 16.3x 17.1x 16.4x 16.1x 14.5x 12.1x 17.9x 13.8x 34.3x 14.4x Dividend yield 4.2% 3.0% 2.8% 2.9% 2.7% 2.2% 5.7% 4.9% 5.1% 1.7% 3.4% v 15-year average 3.9% 2.8% 2.8% 2.8% 2.8% 2.8% 4.3% 4.6% 4.9% 1.8% 3.4% Di Source: FactSet, MSCI, J.P Morgan Asset Management. All calculations are total return in local currency, not annualised. *Financials no longer includes real estate which is now a separate section making up 2.6% of the MSCI Europe Value index and 0.5% of the MSCI Europe growth index. It is not included in the chart due to a lack of historical data for the sector. **“Since market peak” represents period 9 October 2007 to end of latest quarter. ***“Since market low” represents period 9 March 2009 to end of latest quarter. Guide to the Markets - UK. Data as of 31 December 2016. 39

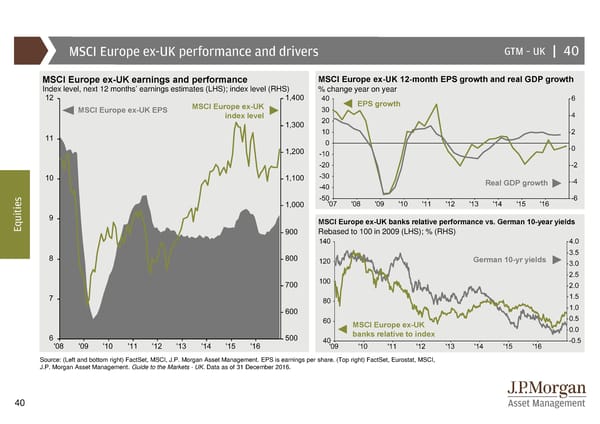

MSCI Europe ex-UK performance and drivers GTM –UK | 40 MSCI Europe ex-UK earnings and performance MSCI Europe ex-UK 12-month EPS growth and real GDP growth Index level, next 12 months’ earnings estimates (LHS); index level (RHS) % change year on year MSCI Europe ex-UK EPS MSCI Europe ex-UK EPS growth index level Real GDP growth s e i t i u MSCI Europe ex-UK banks relative performance vs. German 10-year yields Eq Rebased to 100 in 2009 (LHS); % (RHS) German 10-yr yields MSCI Europe ex-UK banks relative to index Source: (Left and bottom right) FactSet, MSCI, J.P. Morgan Asset Management. EPS is earnings per share. (Top right) FactSet, Eurostat, MSCI, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 40

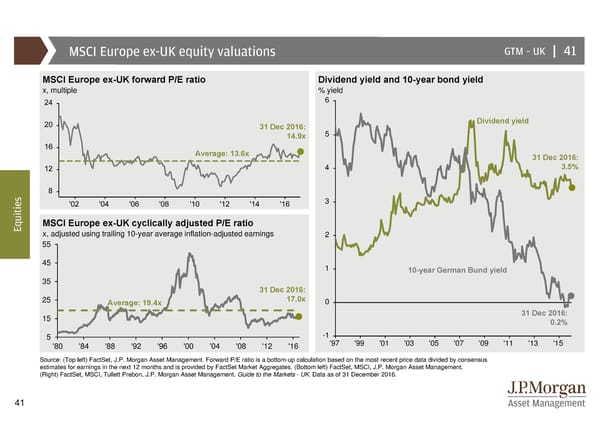

MSCI Europe ex-UK equity valuations GTM –UK | 41 MSCI Europe ex-UK forward P/E ratio Dividend yield and 10-year bond yield x, multiple % yield 6 31 Dec 2016: Dividend yield 14.9x 5 Average: 13.6x 31 Dec 2016: 4 3.5% s 3 e i t i u MSCI Europe ex-UK cyclically adjusted P/E ratio Eq x, adjusted using trailing 10-year average inflation-adjusted earnings 2 55 45 1 10-year German Bund yield 35 31 Dec 2016: 25 Average: 19.4x 17.0x 0 15 31 Dec 2016: 0.2% 5 -1 '80 '84 '88 '92 '96 '00 '04 '08 '12 '16 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 Source: (Top left) FactSet, J.P. Morgan Asset Management. Forward P/E ratio is a bottom-up calculation based on the most recent price data divided by consensus estimates for earnings in the next 12 months and is provided by FactSet Market Aggregates. (Bottom left) FactSet, MSCI, J.P. Morgan Asset Management. (Right) FactSet, MSCI, Tullett Prebon, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 41

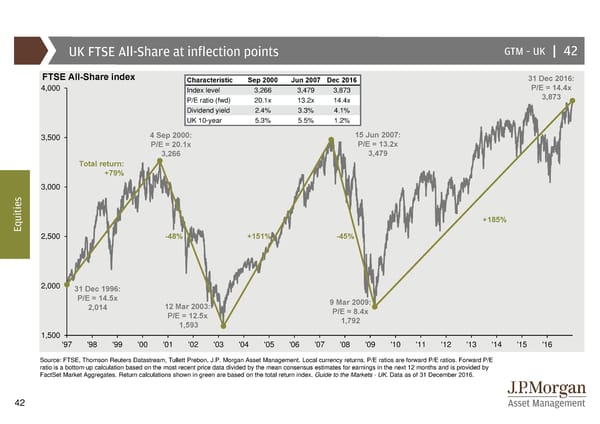

UK FTSE All-Share at inflection points GTM –UK | 42 FTSE All-Share index Characteristic Sep 2000 Jun 2007 Dec2016 31 Dec 2016: 4,000 Index level 3,266 3,479 3,873 P/E = 14.4x P/E ratio (fwd) 20.1x 13.2x 14.4x 3,873 Dividend yield 2.4% 3.3% 4.1% UK 10-year 5.3% 5.5% 1.2% 3,500 4Sep 2000: 15 Jun 2007: P/E = 20.1x P/E = 13.2x 3,266 3,479 Total return: +79% s 3,000 e i t i u +185% Eq 2,500 -48% +151% -45% 2,000 31 Dec 1996: P/E = 14.5x 9 Mar 2009: 2,014 12 Mar 2003: P/E = 8.4x P/E = 12.5x 1,792 1,593 1,500 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: FTSE, Thomson Reuters Datastream, Tullett Prebon, J.P. Morgan Asset Management. Local currency returns. P/E ratios are forward P/E ratios. Forward P/E ratio is a bottom-up calculation based on the most recent price data divided by the mean consensus estimates for earnings in the next 12 months and is provided by FactSet Market Aggregates. Return calculations shown in green are based on the total return index. Guide to the Markets - UK. Data as of 31 December 2016. 42

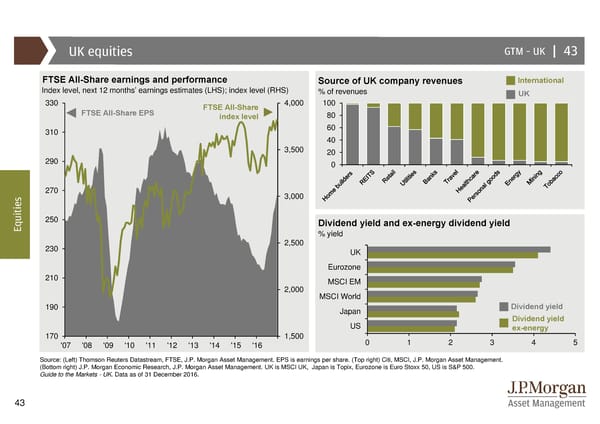

UK equities GTM –UK | 43 FTSE All-Share earnings and performance Source of UK company revenues International Index level, next 12 months’ earnings estimates (LHS); index level (RHS) % of revenues UK 330 FTSE All-Share 4,000 100 FTSE All-Share EPS index level 80 310 60 40 3,500 20 290 0 s 270 3,000 e i t i u 250 Dividend yield and ex-energy dividend yield Eq % yield 230 2,500 UK Eurozone 210 MSCI EM 2,000 MSCI World 190 Japan Dividend yield US Dividend yield 170 1,500 ex-energy '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 012345 Source: (Left) Thomson Reuters Datastream, FTSE, J.P. Morgan Asset Management. EPS is earnings per share. (Top right) Citi, MSCI, J.P. Morgan Asset Management. (Bottom right) J.P. Morgan Economic Research, J.P. Morgan Asset Management. UK is MSCI UK, Japan is Topix, Eurozone is Euro Stoxx 50, US is S&P 500. Guide to the Markets - UK. Data as of 31 December 2016. 43

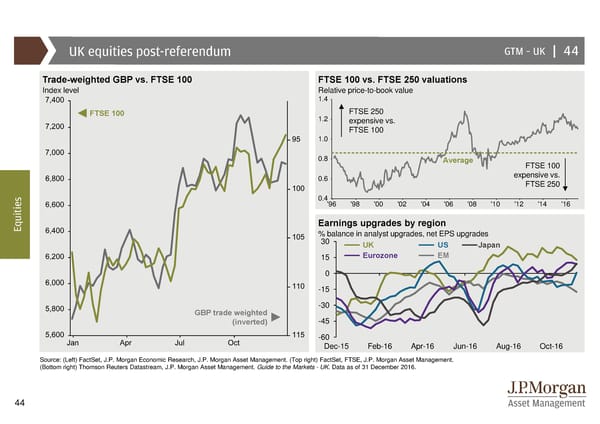

UK equities post-referendum GTM –UK | 44 Trade-weighted GBP vs. FTSE 100 FTSE 100 vs. FTSE 250 valuations Index level Relative price-to-book value 1.4 FTSE 100 FTSE 250 1.2 expensive vs. FTSE 100 1.0 0.8 Average FTSE 100 0.6 expensive vs. FTSE 250 s 0.4 e '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 i t i u Earnings upgrades by region Eq % balance in analyst upgrades, net EPS upgrades 30 UK US Japan 15 Eurozone EM 0 -15 GBP trade weighted -30 (inverted) -45 -60 Dec-15 Feb-16 Apr-16 Jun-16 Aug-16 Oct-16 Source: (Left) FactSet, J.P. Morgan Economic Research, J.P. Morgan Asset Management. (Top right) FactSet, FTSE, J.P. Morgan Asset Management. (Bottom right) Thomson Reuters Datastream, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 44

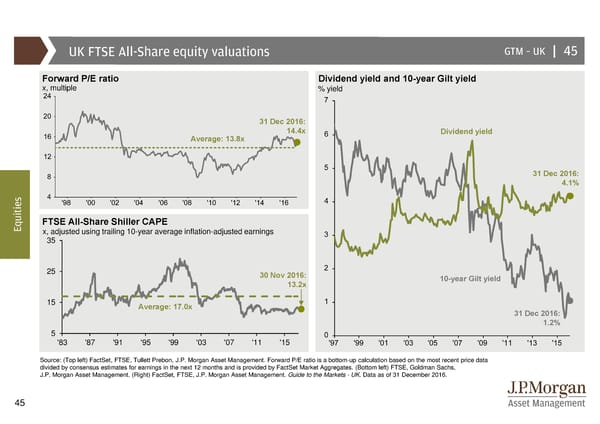

UK FTSE All-Share equity valuations GTM –UK | 45 Forward P/E ratio Dividend yield and 10-year Gilt yield x, multiple % yield 31 Dec 2016: Average: 13.8x 14.4x Dividend yield 31 Dec 2016: 4.1% s e i t i u FTSE All-Share Shiller CAPE Eq x, adjusted using trailing 10-year average inflation-adjusted earnings 35 25 30 Nov 2016: 10-year Gilt yield 13.2x 15 Average: 17.0x 31 Dec 2016: 1.2% 5 '83 '87 '91 '95 '99 '03 '07 '11 '15 Source: (Top left) FactSet, FTSE, Tullett Prebon, J.P. Morgan Asset Management. Forward P/E ratio is a bottom-up calculation based on the most recent price data divided by consensus estimates for earnings in the next 12 months and is provided by FactSet Market Aggregates. (Bottom left) FTSE, Goldman Sachs, J.P. Morgan Asset Management. (Right) FactSet, FTSE, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 45

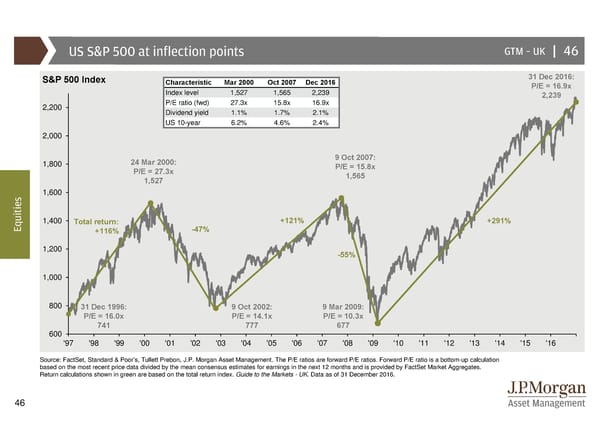

US S&P 500 at inflection points GTM –UK | 46 S&P 500 Index Characteristic Mar 2000 Oct 2007 Dec 2016 31 Dec 2016: Index level 1,527 1,565 2,239 P/E = 16.9x P/E ratio (fwd) 27.3x 15.8x 16.9x 2,239 2,200 Dividend yield 1.1% 1.7% 2.1% US 10-year 6.2% 4.6% 2.4% 2,000 1,800 24 Mar 2000: 9 Oct 2007: P/E = 27.3x P/E = 15.8x 1,527 1,565 s 1,600 e i t i u 1,400 Total return: +121% +291% Eq +116% -47% 1,200 -55% 1,000 800 31 Dec 1996: 9 Oct 2002: 9 Mar 2009: P/E = 16.0x P/E = 14.1x P/E = 10.3x 741 777 677 600 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: FactSet, Standard & Poor’s, Tullett Prebon, J.P. Morgan Asset Management. The P/E ratios are forward P/E ratios. Forward P/E ratio is a bottom-up calculation based on the most recent price data divided by the mean consensus estimates for earnings in the next 12 months and is provided by FactSet Market Aggregates. Return calculations shown in green are based on the total return index. Guide to the Markets - UK. Data as of 31 December 2016. 46

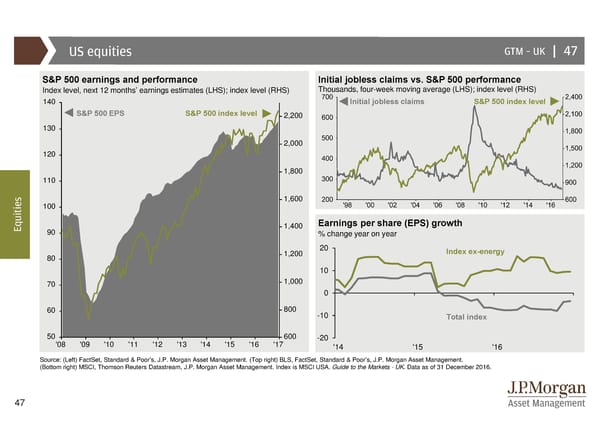

US equities GTM –UK | 47 S&P 500 earnings and performance Initial jobless claims vs. S&P 500 performance Index level, next 12 months’ earnings estimates (LHS); index level (RHS) Thousands, four-week moving average (LHS); index level (RHS) 140 Initial jobless claims S&P 500 index level S&P 500 EPS S&P 500 index level 2,200 130 2,000 120 1,800 110 s 1,600 e 100 i t i u Earnings per share (EPS) growth Eq 90 1,400 % change year on year 1,200 20 Index ex-energy 80 10 70 1,000 0 60 800 -10 Total index 50 600 -20 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '14 '15 '16 Source: (Left) FactSet, Standard & Poor’s, J.P. Morgan Asset Management. (Top right) BLS, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. (Bottom right) MSCI, Thomson Reuters Datastream, J.P. Morgan Asset Management. Index is MSCI USA. Guide to the Markets - UK. Data as of 31 December 2016. 47

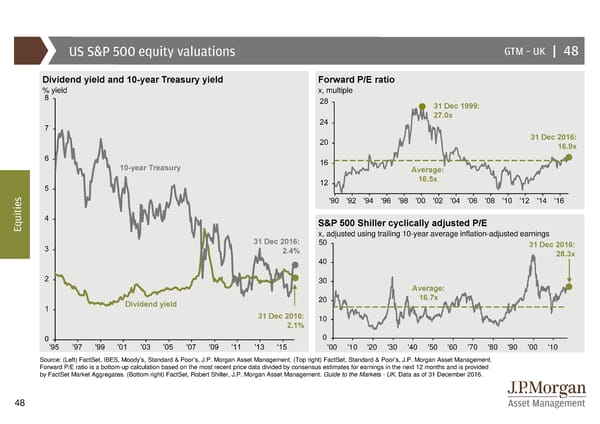

US S&P 500 equity valuations GTM –UK | 48 Dividend yield and 10-year Treasury yield Forward P/E ratio % yield x, multiple 31 Dec 1999: 27.0x 31 Dec 2016: 16.9x 10-year Treasury Average: 16.5x s e i t i u S&P 500 Shiller cyclically adjusted P/E Eq x, adjusted using trailing 10-year average inflation-adjusted earnings 31 Dec 2016: 50 31 Dec 2016: 2.4% 28.3x 40 30 Average: Dividend yield 20 16.7x 31 Dec 2016: 10 2.1% 0 '00 '10 '20 '30 '40 '50 '60 '70 '80 '90 '00 '10 Source: (Left) FactSet, IBES, Moody’s, Standard & Poor’s, J.P. Morgan Asset Management. (Top right) FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Forward P/E ratio is a bottom-up calculation based on the most recent price data divided by consensus estimates for earnings in the next 12 months and is provided by FactSet Market Aggregates. (Bottom right) FactSet, Robert Shiller, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 48

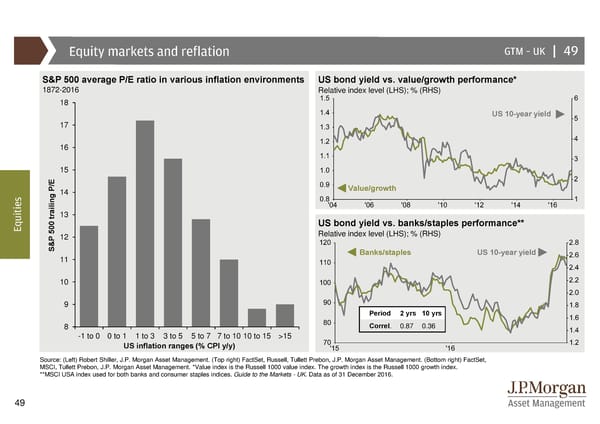

Equity markets and reflation GTM –UK | 49 S&P 500 average P/E ratio in various inflation environments US bond yield vs. value/growth performance* 1872-2016 Relative index level (LHS); % (RHS) 18 US 10-year yield 17 16 15 s 14 Value/growth e i t i trailing P/E13 u US bond yield vs. banks/staples performance** Eq Relative index level (LHS); % (RHS) S&P 500 12 11 Banks/staples US 10-year yield 10 9 Period 2 yrs 10 yrs 8 Correl. 0.87 0.36 -1 to 0 0 to 1 1 to 3 3 to 5 5 to 7 7 to 10 10 to 15 >15 US inflation ranges (% CPI y/y) Source: (Left) Robert Shiller, J.P. Morgan Asset Management. (Top right) FactSet, Russell, Tullett Prebon, J.P. Morgan Asset Management. (Bottom right) FactSet, MSCI, Tullett Prebon, J.P. Morgan Asset Management. *Value index is the Russell 1000 value index. The growth index is the Russell 1000 growth index. **MSCI USA index used for both banks and consumer staples indices. Guide to the Markets - UK. Data as of 31 December 2016. 49

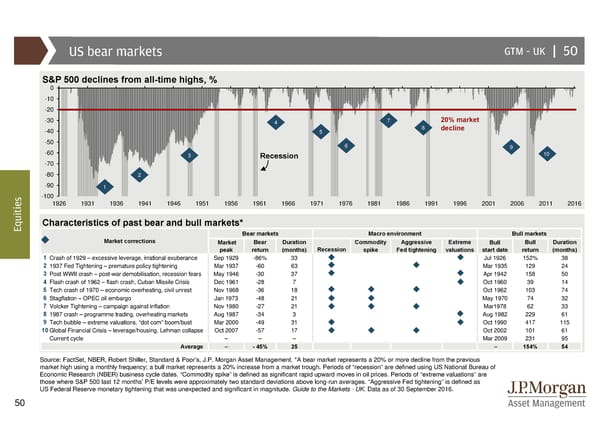

US bear markets GTM –UK | 50 S&P 500 declines from all-time highs, % 0 -10 -20 -30 4 7 20% market -40 5 8 decline -50 6 9 -60 3 Recession 10 -70 -80 2 -90 1 s -100 e 1926 1931 1936 1941 1946 1951 1956 1961 1966 1971 1976 1981 1986 1991 1996 2001 2006 2011 2016 i t i u Characteristics of past bear and bull markets* Eq Bear markets Macro environment Bull markets Market corrections Market Bear Duration Commodity Aggressive Extreme Bull Bull Duration peak return (months) Recession spike Fed tightening valuations start date return (months) 1 Crash of 1929 – excessive leverage, irrational exuberance Sep1929 -86% 33 Jul 1926 152% 38 2 1937 Fed Tightening – premature policy tightening Mar 1937 -60 63 Mar 1935 129 24 3 Post WWII crash – post-war demobilisation, recession fears May1946 -30 37 Apr 1942 158 50 4 Flash crash of 1962 – flash crash, Cuban Missile Crisis Dec1961 -28 7 Oct 1960 39 14 5 Tech crash of 1970 – economic overheating, civil unrest Nov 1968 -36 18 Oct 1962 103 74 6 Stagflation – OPEC oil embargo Jan 1973 -48 21 May 1970 74 32 7 Volcker Tightening – campaign against inflation Nov1980 -27 21 Mar1978 62 33 8 1987 crash – programme trading, overheating markets Aug1987 -34 3 Aug 1982 229 61 9 Tech bubble – extreme valuations, “dot com” boom/bust Mar 2000 -49 31 Oct 1990 417 115 10Global Financial Crisis – leverage/housing, Lehman collapse Oct 2007 -57 17 Oct 2002 101 61 Current cycle – – – Mar 2009 231 95 Average – - 45% 25 – 154% 54 Source: FactSet, NBER, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management. *A bear market represents a 20% or more decline from the previous market high using a monthly frequency; a bull market represents a 20% increase from a market trough. Periods of “recession” are defined using US National Bureau of Economic Research (NBER) business cycle dates. “Commodity spike” is defined as significant rapid upward moves in oil prices. Periods of “extreme valuations” are those where S&P 500 last 12 months’ P/E levels were approximately two standard deviations above long-run averages. “Aggressive Fed tightening” is defined as US Federal Reserve monetary tightening that was unexpected and significant in magnitude. Guide to the Markets - UK. Data as of 30 September 2016. 50

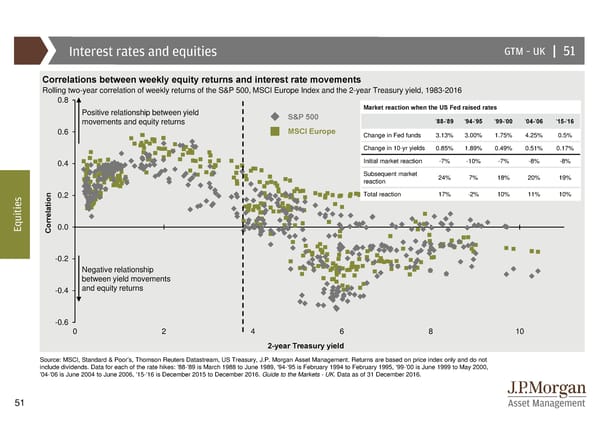

Interest rates and equities GTM –UK | 51 Correlations between weekly equity returns and interest rate movements Rolling two-year correlation of weekly returns of the S&P 500, MSCI Europe Index and the 2-year Treasury yield, 1983-2016 0.8 Positive relationship between yield Market reaction when the US Fed raised rates movements and equity returns S&P 500 '88-'89 '94-'95 '99-'00 '04-'06 '15-'16 0.6 MSCI Europe Change in Fed funds 3.13% 3.00% 1.75% 4.25% 0.5% Change in 10-yr yields 0.85% 1.89% 0.49% 0.51% 0.17% 0.4 Initial market reaction -7% -10% -7% -8% -8% Subsequent market 24% 7% 18% 20% 19% reaction s 0.2 Total reaction 17% -2% 10% 11% 10% e i t i u Eq Correlation 0.0 -0.2 Negative relationship between yield movements -0.4 and equity returns -0.6 0246810 2-year Treasury yield Source: MSCI, Standard & Poor’s, Thomson Reuters Datastream, US Treasury, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Data for each of the rate hikes: '88-'89 is March 1988 to June 1989, '94-'95 is February 1994 to February 1995, '99-'00 is June 1999 to May 2000, '04-'06 is June 2004 to June 2006, '15-'16 is December 2015 to December 2016. Guide to the Markets - UK. Data as of 31 December 2016. 51

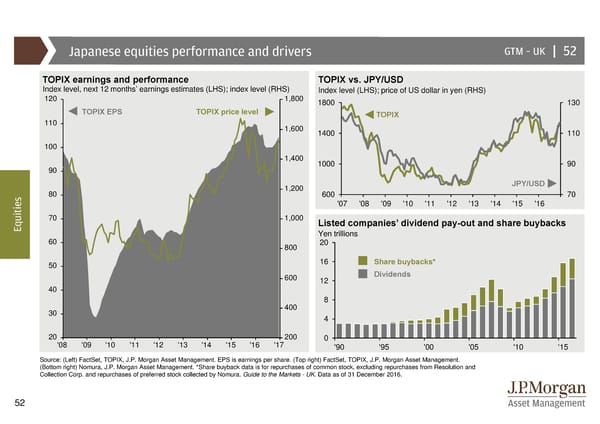

Japanese equities performance and drivers GTM –UK | 52 TOPIX earnings and performance TOPIX vs. JPY/USD Index level, next 12 months’ earnings estimates (LHS); index level (RHS) Index level (LHS); price of US dollar in yen (RHS) 120 1,800 1800 130 TOPIX EPS TOPIX price level TOPIX 110 1,600 1400 110 100 1,400 1000 90 90 1,200 JPY/USD s 80 600 70 e '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 i t i 70 1,000 u Listed companies’ dividend pay-out and share buybacks Eq Yen trillions 60 800 20 50 16 Share buybacks* 600 12 Dividends 40 400 8 30 4 20 200 0 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '90 '95 '00 '05 '10 '15 Source: (Left) FactSet, TOPIX, J.P. Morgan Asset Management. EPS is earnings per share. (Top right) FactSet, TOPIX, J.P. Morgan Asset Management. (Bottom right) Nomura, J.P. Morgan Asset Management. *Share buyback data is for repurchases of common stock, excluding repurchases from Resolution and Collection Corp. and repurchases of preferred stock collected by Nomura. Guide to the Markets - UK. Data as of 31 December 2016. 52

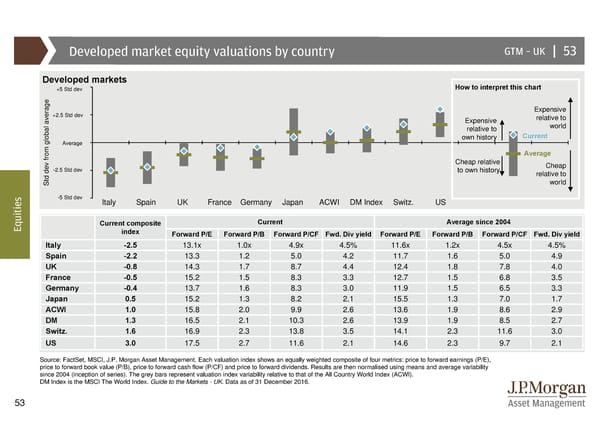

Developed market equity valuations by country GTM –UK | 53 Developed markets How to interpret this chart +5 Std dev +2.5 Std dev Expensive Expensive relative to relative to world global average own history Current Average Average Cheap relative Cheap -2.5 Std dev to own history relative to Std dev from world s -5 Std dev Italy Spain UK France Germany Japan ACWI DM Index Switz. US e i t i u Current Average since 2004 Eq Current composite index Forward P/E Forward P/B Forward P/CF Fwd. Divyield Forward P/E Forward P/B Forward P/CF Fwd. Divyield Italy -2.5 13.1x 1.0x 4.9x 4.5% 11.6x 1.2x 4.5x 4.5% Spain -2.2 13.3 1.2 5.0 4.2 11.7 1.6 5.0 4.9 UK -0.8 14.3 1.7 8.7 4.4 12.4 1.8 7.8 4.0 France -0.5 15.2 1.5 8.3 3.3 12.7 1.5 6.8 3.5 Germany -0.4 13.7 1.6 8.3 3.0 11.9 1.5 6.5 3.3 Japan 0.5 15.2 1.3 8.2 2.1 15.5 1.3 7.0 1.7 ACWI 1.0 15.8 2.0 9.9 2.6 13.6 1.9 8.6 2.9 DM 1.3 16.5 2.1 10.3 2.6 13.9 1.9 8.5 2.7 Switz. 1.6 16.9 2.3 13.8 3.5 14.1 2.3 11.6 3.0 US 3.0 17.5 2.7 11.6 2.1 14.6 2.3 9.7 2.1 Source: FactSet, MSCI, J.P. Morgan Asset Management. Each valuation index shows an equally weighted composite of four metrics: price to forward earnings (P/E), price to forward book value (P/B), price to forward cash flow (P/CF) and price to forward dividends. Results are then normalised using means and average variability since 2004 (inception of series). The grey bars represent valuation index variability relative to that of the All Country World Index (ACWI). DM Index is the MSCI The World Index. Guide to the Markets - UK. Data as of 31 December 2016. 53

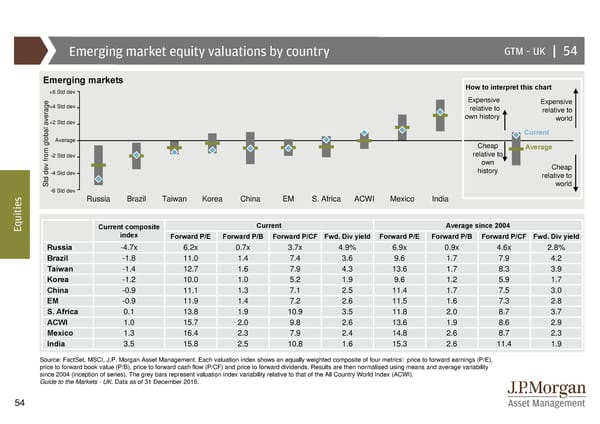

Emerging market equity valuations by country GTM –UK | 54 Emerging markets How to interpret this chart +6 Std dev Expensive Expensive +4 Std dev relative to relative to average+2 Std dev own history world Current Average Cheap relative to Average from global -2 Std dev own Cheap dev-4 Std dev history relative to Std world s -6 Std dev e Russia Brazil Taiwan Korea China EM S. Africa ACWI Mexico India i t i u Eq Current composite Current Average since 2004 index Forward P/E Forward P/B Forward P/CF Fwd. Divyield Forward P/E Forward P/B Forward P/CF Fwd. Divyield Russia -4.7x 6.2x 0.7x 3.7x 4.9% 6.9x 0.9x 4.6x 2.8% Brazil -1.8 11.0 1.4 7.4 3.6 9.6 1.7 7.9 4.2 Taiwan -1.4 12.7 1.6 7.9 4.3 13.6 1.7 8.3 3.9 Korea -1.2 10.0 1.0 5.2 1.9 9.6 1.2 5.9 1.7 China -0.9 11.1 1.3 7.1 2.5 11.4 1.7 7.5 3.0 EM -0.9 11.9 1.4 7.2 2.6 11.5 1.6 7.3 2.8 S. Africa 0.1 13.8 1.9 10.9 3.5 11.8 2.0 8.7 3.7 ACWI 1.0 15.7 2.0 9.8 2.6 13.6 1.9 8.6 2.9 Mexico 1.3 16.4 2.3 7.9 2.4 14.8 2.6 8.7 2.3 India 3.5 15.8 2.5 10.8 1.6 15.3 2.6 11.4 1.9 Source: FactSet, MSCI, J.P. Morgan Asset Management. Each valuation index shows an equally weighted composite of four metrics: price to forward earnings (P/E), price to forward book value (P/B), price to forward cash flow (P/CF) and price to forward dividends. Results are then normalised using means and average variability since 2004 (inception of series). The grey bars represent valuation index variability relative to that of the All Country World Index (ACWI). Guide to the Markets - UK. Data as of 31 December 2016. 54

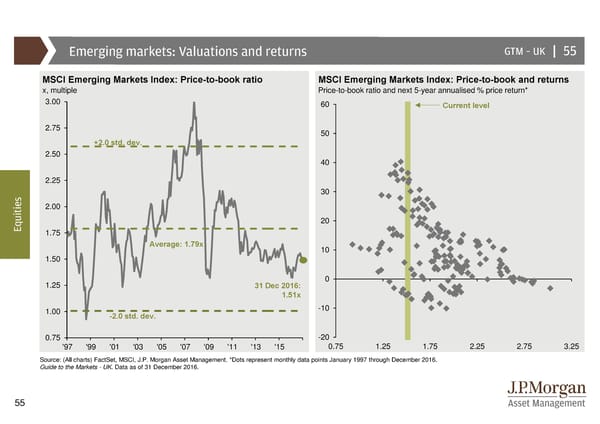

Emerging markets: Valuations and returns GTM –UK | 55 MSCI Emerging Markets Index: Price-to-book ratio MSCI Emerging Markets Index: Price-to-book and returns x, multiple Price-to-book ratio and next 5-year annualised % price return* 3.00 60 Current level 2.75 50 +2.0 std. dev. 2.50 40 2.25 s 30 e 2.00 i t i u 20 Eq 1.75 Average: 1.79x 10 1.50 1.25 31 Dec 2016: 0 1.51x 1.00 -10 -2.0 std. dev. 0.75 -20 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 0.75 1.25 1.75 2.25 2.75 3.25 Source: (All charts) FactSet, MSCI, J.P. Morgan Asset Management. *Dots represent monthly data points January 1997 through December 2016. Guide to the Markets - UK. Data as of 31 December 2016. 55

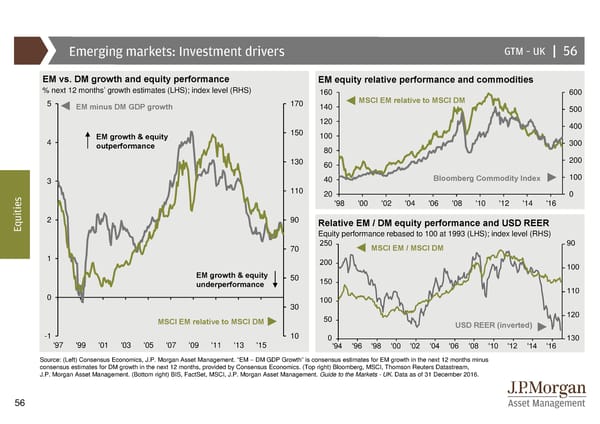

Emerging markets: Investment drivers GTM –UK | 56 EM vs. DM growth and equity performance EM equity relative performance and commodities % next 12 months’ growth estimates (LHS); index level (RHS) 160 600 5 EM minus DM GDP growth 170 140 MSCI EM relative to MSCI DM 500 120 400 EM growth & equity 150 100 4 outperformance 300 80 130 60 200 3 40 Bloomberg Commodity Index 100 s 110 20 0 e '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 i t i u 2 90 Relative EM / DM equity performance and USD REER Eq Equity performance rebased to 100 at 1993 (LHS); index level (RHS) 70 MSCI EM / MSCI DM 1 EM growth & equity 50 underperformance 0 30 MSCI EM relative to MSCI DM USD REER (inverted) -1 10 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 Source: (Left) Consensus Economics, J.P. Morgan Asset Management. “EM – DM GDP Growth” is consensus estimates for EM growth in the next 12 months minus consensus estimates for DM growth in the next 12 months, provided by Consensus Economics. (Top right) Bloomberg, MSCI, Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom right) BIS, FactSet, MSCI, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 56

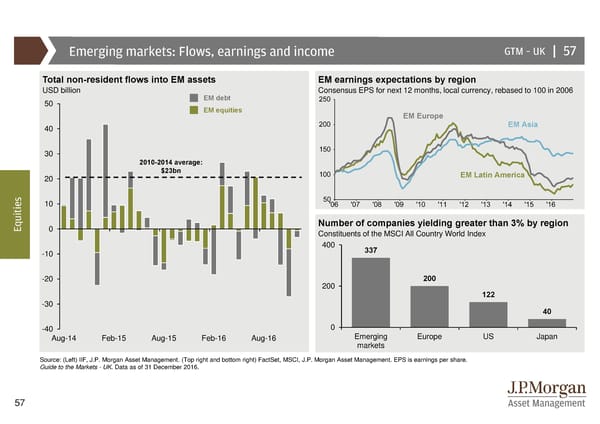

Emerging markets: Flows, earnings and income GTM –UK | 57 Total non-resident flows into EM assets EM earnings expectations by region USD billion Consensus EPS for next 12 months, local currency, rebased to 100 in 2006 50 EM debt EM equities EM Europe 40 EM Asia 30 2010-2014 average: 20 $23bn EM Latin America s 10 e i t i u Number of companies yielding greater than 3% by region Eq 0 Constituents of the MSCI All Country World Index 400 337 -10 -20 200 200 122 -30 40 -40 0 Aug-14 Feb-15 Aug-15 Feb-16 Aug-16 Emerging Europe US Japan markets Source: (Left) IIF, J.P. Morgan Asset Management. (Top right and bottom right) FactSet, MSCI, J.P. Morgan Asset Management. EPS is earnings per share. Guide to the Markets - UK. Data as of 31 December 2016. 57

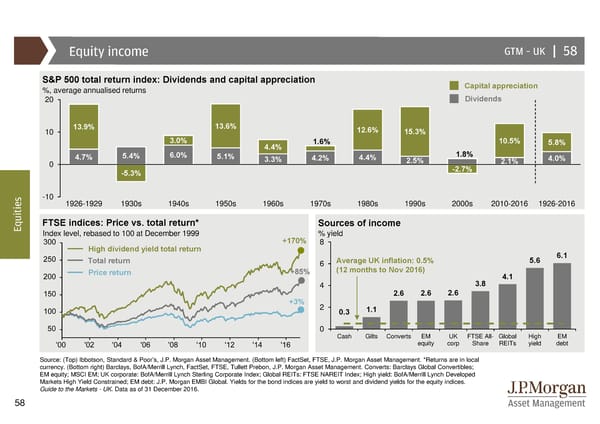

Equity income GTM –UK | 58 S&P 500 total return index: Dividends and capital appreciation Capital appreciation %, average annualised returns 20 Dividends 10 13.9% 13.6% 12.6% 15.3% 3.0% 4.4% 1.6% 10.5% 5.8% 4.7% 5.4% 6.0% 5.1% 3.3% 4.2% 4.4% 2.5% 1.8% 2.1% 4.0% 0 -2.7% -5.3% s -10 1926-1929 1930s 1940s 1950s 1960s 1970s 1980s 1990s 2000s 2010-2016 1926-2016 e i t i u FTSE indices: Price vs. total return* Sources of income Eq Index level, rebased to 100 at December 1999 % yield +170% 8 High dividend yield total return 6.1 Total return 6 Average UK inflation: 0.5% 5.6 Price return +85% (12 months to Nov 2016) 4.1 4 3.8 2.6 2.6 2.6 +3% 2 1.1 0.3 0 Cash Gilts Converts EM UK FTSE All- Global High EM equity corp Share REITs yield debt Source: (Top) Ibbotson, Standard & Poor’s, J.P. Morgan Asset Management. (Bottom left) FactSet, FTSE, J.P. Morgan Asset Management. *Returns are in local currency. (Bottom right) Barclays, BofA/Merrill Lynch, FactSet, FTSE, Tullett Prebon, J.P. Morgan Asset Management. Converts: Barclays Global Convertibles; EM equity; MSCI EM; UK corporate: BofA/Merrill Lynch Sterling Corporate Index; Global REITs: FTSE NAREIT Index; High yield: BofA/Merrill Lynch Developed Markets High Yield Constrained; EM debt: J.P. Morgan EMBI Global. Yields for the bond indices are yield to worst and dividend yields for the equity indices. Guide to the Markets - UK. Data as of 31 December 2016. 58

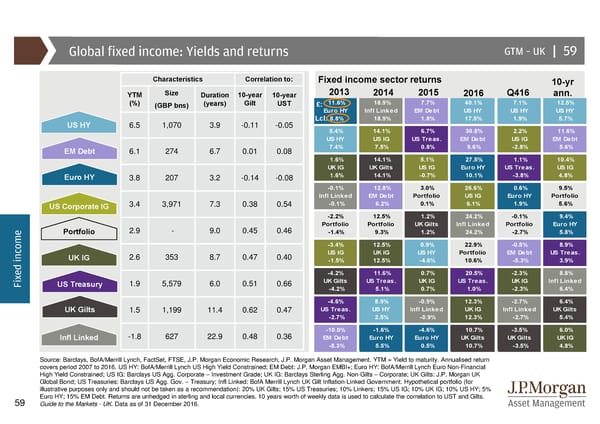

Global fixed income: Yields and returns GTM –UK || 59 Characteristics Correlation to: Fixed income sector returns 10-yr YTM Size Duration 10-year 10-year 2013 2014 2015 2016 Q416 ann. (%) (GBP bns) (years) Gilt UST £: 11.6% 18.9% 7.7% 40.1% 7.1% 12.5% Euro HY Infl Linked EM Debt US HY US HY US HY US HY 6.5 1,070 3.9 -0.11 -0.05 Lcl: 8.8% 18.9% 1.8% 17.5% 1.9% 5.7% 5.4% 14.1% 6.7% 30.8% 2.2% 11.6% US HY US IG US Treas. EM Debt US IG EM Debt EM Debt 6.1 274 6.7 0.01 0.08 7.4% 7.5% 0.8% 9.6% -2.8% 5.6% 1.6% 14.1% 5.1% 27.5% 1.1% 10.4% UK IG UK Gilts US IG Euro HY US Treas. US IG Euro HY 3.8 207 3.2 -0.14 -0.08 1.6% 14.1% -0.7% 10.1% -3.8% 4.8% -0.1% 12.8% 3.0% 26.6% 0.6% 9.5% Infl Linked EM Debt Portfolio US IG Euro HY Portfolio US Corporate IG 3.4 3,971 7.3 0.38 0.54 -0.1% 6.2% 0.1% 6.1% 1.9% 5.6% -2.2% 12.5% 1.2% 24.2% -0.1% 9.4% 2.9 - 9.0 0.45 0.46 Portfolio Portfolio UK Gilts Infl Linked Portfolio Euro HY e Portfolio -1.4% 9.3% 1.2% 24.2% -2.7% 5.8% m -3.4% 12.5% 0.9% 22.9% -0.5% 8.9% o c US IG UK IG US HY Portfolio EM Debt US Treas. n UK IG 2.6 353 8.7 0.47 0.40 i -1.5% 12.5% -4.6% 10.6% -5.3% 3.9% d e -4.2% 11.6% 0.7% 20.5% -2.3% 8.8% x UK Gilts US Treas. UK IG US Treas. UK IG Infl Linked Fi US Treasury 1.9 5,579 6.0 0.51 0.66 -4.2% 5.1% 0.7% 1.0% -2.3% 6.4% -4.6% 8.9% -0.9% 12.3% -2.7% 6.4% UK Gilts 1.5 1,199 11.4 0.62 0.47 US Treas. US HY Infl Linked UK IG Infl Linked UK Gilts -2.7% 2.5% -0.9% 12.3% -2.7% 5.4% -1.8 627 22.9 0.48 0.36 -10.0% -1.6% -4.6% 10.7% -3.5% 6.0% Infl Linked EM Debt Euro HY Euro HY UK Gilts UK Gilts UK IG -8.3% 5.5% 0.5% 10.7% -3.5% 4.8% Source: Barclays, BofA/Merrill Lynch, FactSet, FTSE, J.P. Morgan Economic Research, J.P. Morgan Asset Management. YTM = Yield to maturity. Annualised return covers period 2007 to 2016. US HY: BofA/Merrill Lynch US High Yield Constrained; EM Debt: J.P. Morgan EMBI+; Euro HY: BofA/Merrill Lynch Euro Non-Financial High Yield Constrained; US IG: Barclays US Agg. Corporate – Investment Grade; UK IG: Barclays Sterling Agg. Non-Gilts – Corporate; UK Gilts: J.P. Morgan UK Global Bond; US Treasuries: Barclays US Agg. Gov. – Treasury; Infl Linked: BofA Merrill Lynch UK Gilt Inflation-Linked Government. Hypothetical portfolio (for illustrative purposes only and should not be taken as a recommendation): 20% UK Gilts; 15% US Treasuries; 10% Linkers; 15% US IG; 10% UK IG; 10% US HY; 5% Euro HY; 15% EM Debt. Returns are unhedged in sterling and local currencies. 10 years worth of weekly data is used to calculate the correlation to UST and Gilts. 59 Guide to the Markets - UK. Data as of 31 December 2016.

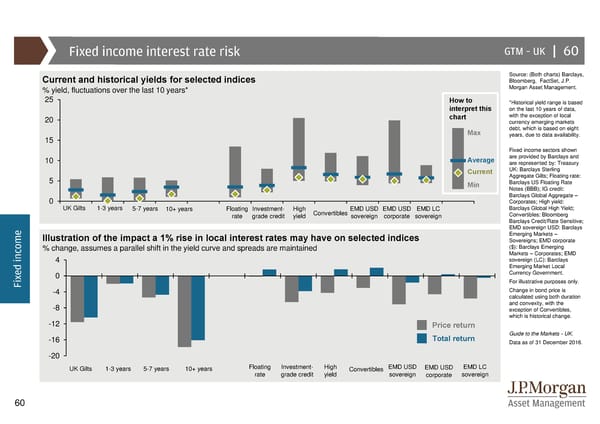

Fixed income interest rate risk GTM –UK | 60 Source: (Both charts) Barclays, Current and historical yields for selected indices Bloomberg, FactSet, J.P. % yield, fluctuations over the last 10 years* Morgan Asset Management. 25 How to *Historical yield range is based interpret this on the last 10 years of data, 20 chart with the exception of local currency emerging markets Max debt, which is based on eight 15 years, due to data availability. Fixed income sectors shown 10 Average are provided by Barclays and are represented by: Treasury Current UK: Barclays Sterling 5 Aggregate Gilts; Floating rate: Min Barclays US Floating Rate Notes (BBB); IG credit: Barclays Global Aggregate – 0 Corporates; High yield: UK Gilts 1-3 years 5-7 years 10+ years Floating Investment- High Convertibles EMD USD EMD USD EMD LC Barclays Global High Yield; rate grade credit yield sovereign corporate sovereign Convertibles: Bloomberg Barclays Credit/Rate Sensitive; e EMD sovereign USD: Barclays Illustration of the impact a 1% rise in local interest rates may have on selected indices Emerging Markets – m Sovereigns; EMD corporate o % change, assumes a parallel shift in the yield curve and spreads are maintained ($): Barclays Emerging c Markets – Corporates; EMD n 4 sovereign (LC): Barclays i d Emerging Market Local e 0 Currency Government. x Fi For illustrative purposes only. -4 Change in bond price is calculated using both duration -8 and convexity, with the exception of Convertibles, which is historical change. -12 Price return -16 Total return Guide to the Markets - UK. Data as of 31 December 2016. -20 UK Gilts 1-3 years 5-7 years 10+ years Floating Investment- High Convertibles EMD USD EMD USD EMD LC rate grade credit yield sovereign corporate sovereign 60

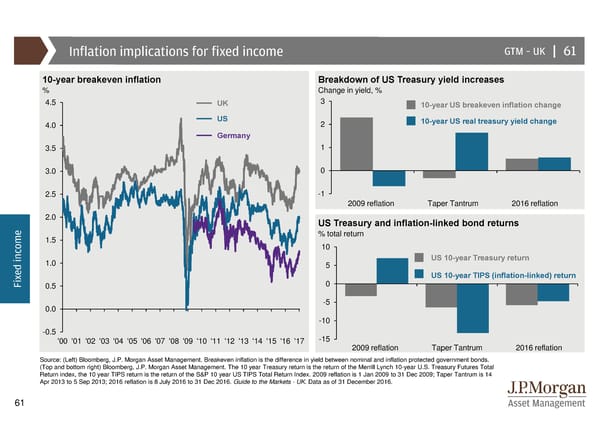

Inflation implications for fixed income GTM –UK | 61 10-year breakeven inflation Breakdown of US Treasury yield increases % Change in yield, % 4.5 UK 3 10-year US breakeven inflation change 4.0 US 2 10-year US real treasury yield change Germany 3.5 1 3.0 0 2.5 -1 2009 reflation Taper Tantrum 2016 reflation 2.0 US Treasury and inflation-linked bond returns e % total return m 1.5 o 10 c n US 10-year Treasury return i 1.0 5 d e US 10-year TIPS (inflation-linked) return x Fi 0.5 0 0.0 -5 -10 -0.5 -15 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 2009 reflation Taper Tantrum 2016 reflation Source: (Left) Bloomberg, J.P. Morgan Asset Management. Breakeven inflation is the difference in yield between nominal and inflation protected government bonds. (Top and bottom right) Bloomberg, J.P. Morgan Asset Management. The 10 year Treasury return is the return of the Merrill Lynch 10-year U.S. Treasury Futures Total Return index, the 10 year TIPS return is the return of the S&P 10 year US TIPS Total Return Index. 2009 reflation is 1 Jan 2009 to 31 Dec 2009; Taper Tantrum is 14 Apr 2013 to 5 Sep 2013; 2016 reflation is 8 July 2016 to 31 Dec 2016. Guide to the Markets - UK. Data as of 31 December 2016. 61

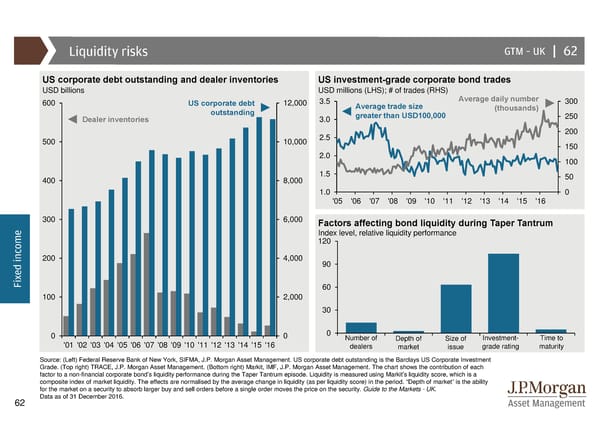

Liquidity risks GTM –UK | 62 US corporate debt outstanding and dealer inventories US investment-grade corporate bond trades USD billions USD millions (LHS); # of trades (RHS) 600 UScorporate debt 12,000 3.5 Average trade size Average daily number 300 outstanding greater than USD100,000 (thousands) 250 Dealer inventories 3.0 2.5 200 500 10,000 150 2.0 100 400 8,000 1.5 50 1.0 0 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 300 6,000 Factors affecting bond liquidity during Taper Tantrum e Index level, relative liquidity performance m 120 o c n 200 4,000 i 90 d e x Fi 60 100 2,000 30 0 0 0 Number of Depth of Size of Investment- Time to '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 dealers market issue grade rating maturity Source: (Left) Federal Reserve Bank of New York, SIFMA, J.P. Morgan Asset Management. US corporate debt outstanding is the Barclays US Corporate Investment Grade. (Top right) TRACE, J.P. Morgan Asset Management. (Bottom right) Markit, IMF, J.P. Morgan Asset Management. The chart shows the contribution of each factor to a non-financial corporate bond’s liquidity performance during the Taper Tantrum episode. Liquidity is measured using Markit’s liquidity score, which is a composite index of market liquidity. The effects are normalised by the average change in liquidity (as per liquidity score) in the period. “Depth of market” is the ability for the market on a security to absorb larger buy and sell orders before a single order moves the price on the security. Guide to the Markets - UK. Data as of 31 December 2016. 62

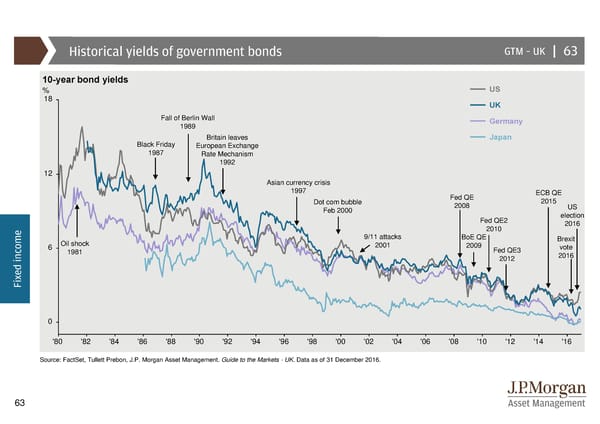

Historical yields of government bonds GTM –UK | 63 10-year bond yields % US 18 UK Fall of Berlin Wall Germany 1989 Black Friday Britain leaves Japan 1987 European Exchange Rate Mechanism 1992 12 Asian currency crisis 1997 Fed QE ECB QE Dot com bubble 2008 2015 US Feb 2000 election Fed QE2 2016 e 2010 m Oil shock 9/11 attacks BoE QE Brexit o 6 2001 2009 Fed QE3 vote c 1981 2016 n 2012 i d e x Fi 0 '80 '82 '84 '86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 Source: FactSet, Tullett Prebon, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 63

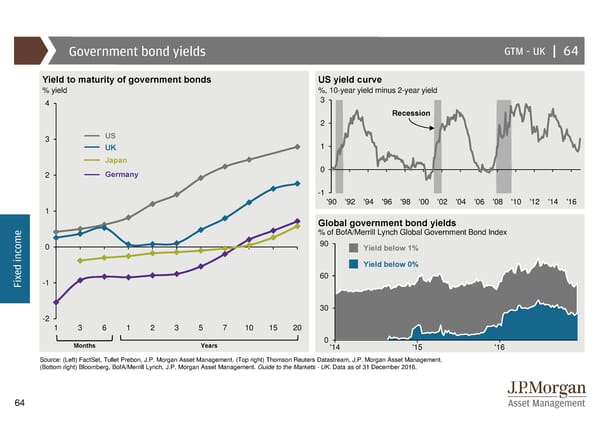

Government bond yields GTM –UK | 64 Yield to maturity of government bonds US yield curve % yield %, 10-year yield minus 2-year yield 4 3 Recession 2 3 US UK 1 Japan 2 Germany 0 -1 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 '16 1 Global government bond yields e % of BofA/Merrill Lynch Global Government Bond Index m 90 o 0 Yield below 1% c n i Yield below 0% d e 60 x -1 Fi 30 -2 13612357101520 Months Years 0'14 '15 '16 Source: (Left) FactSet, Tullet Prebon, J.P. Morgan Asset Management. (Top right) Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom right) Bloomberg, BofA/Merrill Lynch, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 64

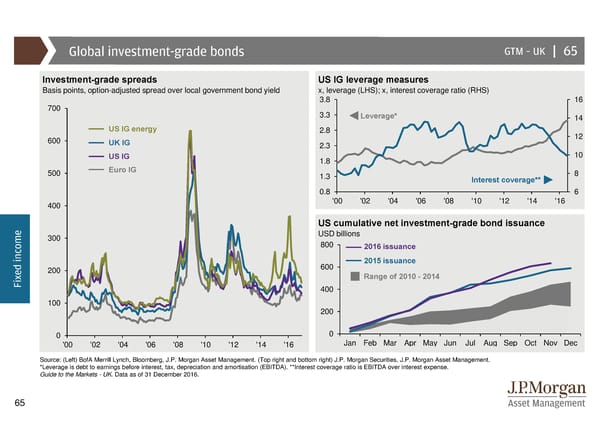

Global investment-grade bonds GTM –UK | 65 Investment-grade spreads US IG leverage measures Basis points, option-adjusted spread over local government bond yield x, leverage (LHS); x, interest coverage ratio (RHS) 3.8 16 700 3.3 Leverage* 14 US IG energy 2.8 12 600 UK IG 2.3 US IG 1.8 10 500 Euro IG 1.3 8 Interest coverage** 0.8 6 400 '00 '02 '04 '06 '08 '10 '12 '14 '16 e US cumulative net investment-grade bond issuance m 300 USD billions o 800 2016 issuance c n 2015 issuance i 600 d 200 e Range of 2010 - 2014 x Fi 400 100 200 0 0 '00 '02 '04 '06 '08 '10 '12 '14 '16 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: (Left) BofA Merrill Lynch, Bloomberg, J.P. Morgan Asset Management. (Top right and bottom right) J.P. Morgan Securities, J.P. Morgan Asset Management. *Leverage is debt to earnings before interest, tax, depreciation and amortisation (EBITDA). **Interest coverage ratio is EBITDA over interest expense. Guide to the Markets - UK. Data as of 31 December 2016. 65

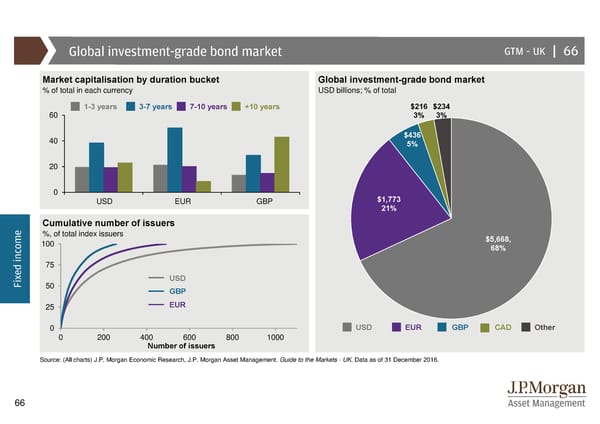

Global investment-grade bond market GTM –UK | 66 Market capitalisation by duration bucket Global investment-grade bond market % of total in each currency USD billions; % of total 1-3 years 3-7 years 7-10 years +10 years $216 $234 60 3% 3% 40 $436 5% 20 0 $1,773 USD EUR GBP 21% e Cumulative number of issuers m %, of total index issuers $5,668, o 100 68% c n i 75 d e x USD Fi 50 GBP 25 EUR 0 USD EUR GBP CAD Other 0 200 400 600 800 1000 Number of issuers Source: (All charts) J.P. Morgan Economic Research, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 66

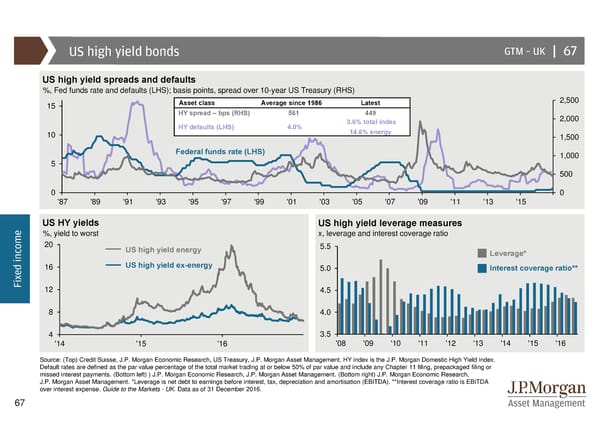

US high yield bonds GTM –UK | 67 US high yield spreads and defaults %, Fed funds rate and defaults (LHS); basis points, spread over 10-year US Treasury (RHS) 15 Asset class Average since 1986 Latest 2,500 HY spread – bps (RHS) 561 449 2,000 HY defaults (LHS) 4.0% 3.6% total index 10 14.6% energy 1,500 Federal funds rate (LHS) 1,000 5 500 0 0 '87 '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 e US HY yields US high yield leverage measures m %, yield to worst x, leverage and interest coverage ratio o 20 US high yield energy 5.5 c Leverage* n i 16 US high yield ex-energy d 5.0 Interest coverage ratio** e x Fi 12 4.5 8 4.0 4 3.5 '14 '15 '16 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: (Top) Credit Suisse, J.P. Morgan Economic Research, US Treasury, J.P. Morgan Asset Management. HY index is the J.P. Morgan Domestic High Yield index. Default rates are defined as the par value percentage of the total market trading at or below 50% of par value and include any Chapter 11 filing, prepackaged filing or missed interest payments. (Bottom left) ) J.P. Morgan Economic Research, J.P. Morgan Asset Management. (Bottom right) J.P. Morgan Economic Research, J.P. Morgan Asset Management. *Leverage is net debt to earnings before interest, tax, depreciation and amortisation (EBITDA). **Interest coverage ratio is EBITDA over interest expense. Guide to the Markets - UK. Data as of 31 December 2016. 67

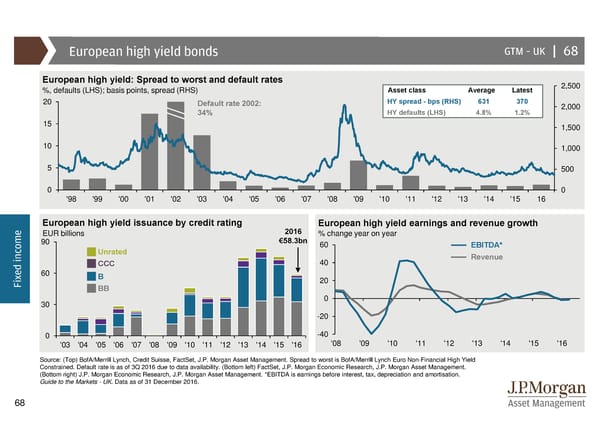

European high yield bonds GTM –UK | 68 European high yield: Spread to worst and default rates 2,500 %, defaults (LHS); basis points, spread (RHS) Asset class Average Latest 20 Default rate 2002: HY spread - bps (RHS) 631 370 2,000 34% HY defaults (LHS) 4.8% 1.2% 15 1,500 10 1,000 5 500 0 0 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 16 European high yield issuance by credit rating European high yield earnings and revenue growth e EUR billions 2016 % change year on year m 90 €58.3bn 60 EBITDA* o c Unrated n Revenue i CCC 40 d e 60 B x 20 Fi BB 30 0 -20 0 -40 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '08 '09 '10 '11 '12 '13 '14 '15 '16 Source: (Top) BofA/Merrill Lynch, Credit Suisse, FactSet, J.P. Morgan Asset Management. Spread to worst is BofA/Merrill Lynch Euro Non-Financial High Yield Constrained. Default rate is as of 3Q 2016 due to data availability. (Bottom left) FactSet, J.P. Morgan Economic Research, J.P. Morgan Asset Management. (Bottom right) J.P. Morgan Economic Research, J.P. Morgan Asset Management. *EBITDA is earnings before interest, tax, depreciation and amortisation. Guide to the Markets - UK. Data as of 31 December 2016. 68

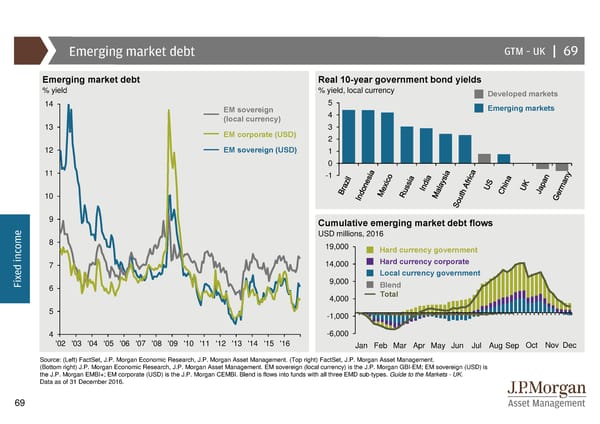

Emerging market debt GTM –UK | 69 Emerging market debt Real 10-year government bond yields % yield % yield, local currency Developed markets 14 EM sovereign 5 Emerging markets (local currency) 4 13 3 EM corporate (USD) 2 12 EM sovereign (USD) 1 0 11 -1 10 9 Cumulative emerging market debt flows e USD millions, 2016 m 8 o 19,000 Hard currency government c n Hard currency corporate i 7 14,000 d e Local currency government x 9,000 Fi 6 Blend 4,000 Total 5 -1,000 4 -6,000 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: (Left) FactSet, J.P. Morgan Economic Research, J.P. Morgan Asset Management. (Top right) FactSet, J.P. Morgan Asset Management. (Bottom right) J.P. Morgan Economic Research, J.P. Morgan Asset Management. EM sovereign (local currency) is the J.P. Morgan GBI-EM; EM sovereign (USD) is the J.P. Morgan EMBI+; EM corporate (USD) is the J.P. Morgan CEMBI. Blend is flows into funds with all three EMD sub-types. Guide to the Markets - UK. Data as of 31 December 2016. 69

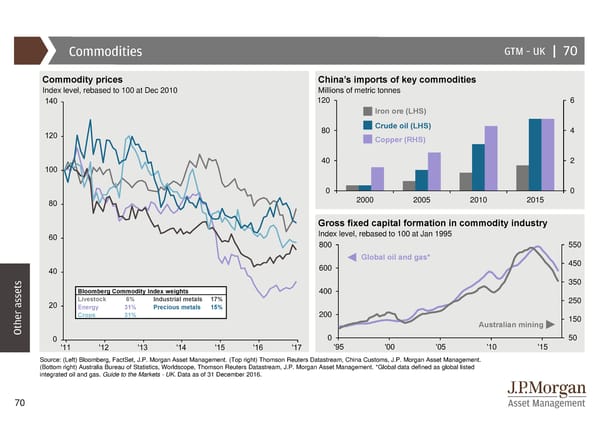

Commodities GTM –UK | 70 Commodity prices China’s imports of key commodities Index level, rebased to 100 at Dec 2010 Millions of metric tonnes 120 6 Iron ore (LHS) 80 Crude oil (LHS) 4 Copper (RHS) 40 2 0 0 2000 2005 2010 2015 Gross fixed capital formation in commodity industry Index level, rebased to 100 at Jan 1995 800 550 Global oil and gas* 450 600 350 Bloomberg Commodity Index weights 400 Livestock 6% Industrial metals 17% 250 Energy 31% Precious metals 15% 200 Crops 31% 150 Other assets Australian mining 0 50 '95 '00 '05 '10 '15 Source: (Left) Bloomberg, FactSet, J.P. Morgan Asset Management. (Top right) Thomson Reuters Datastream, China Customs, J.P. Morgan Asset Management. (Bottom right) Australia Bureau of Statistics, Worldscope, Thomson Reuters Datastream, J.P. Morgan Asset Management. *Global data defined as global listed integrated oil and gas. Guide to the Markets - UK. Data as of 31 December 2016. 70

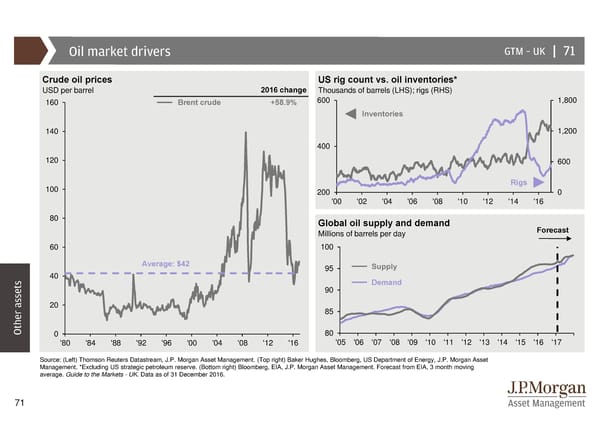

Oil market drivers GTM –UK | 71 Crude oil prices US rig count vs. oil inventories* USD per barrel 2016 change Thousands of barrels (LHS); rigs (RHS) 160 Brent crude +58.9% 600 1,800 Inventories 140 1,200 400 120 600 100 Rigs 200 0 '00 '02 '04 '06 '08 '10 '12 '14 '16 80 Global oil supply and demand Millions of barrels per day Forecast 60 100 Average: $42 95 Supply 40 Demand 90 20 85 Other assets0 80 '80 '84 '88 '92 '96 '00 '04 '08 '12 '16 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Source: (Left) Thomson Reuters Datastream, J.P. Morgan Asset Management. (Top right) Baker Hughes, Bloomberg, US Department of Energy, J.P. Morgan Asset Management. *Excluding US strategic petroleum reserve. (Bottom right) Bloomberg, EIA, J.P. Morgan Asset Management. Forecast from EIA, 3 month moving average. Guide to the Markets - UK. Data as of 31 December 2016. 71

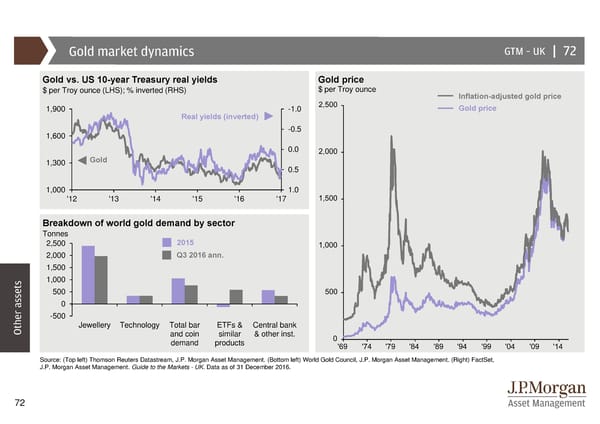

Gold market dynamics GTM –UK | 72 Gold vs. US 10-year Treasury real yields Gold price $ per Troy ounce (LHS); % inverted (RHS) $ per Troy ounce Inflation-adjusted gold price 1,900 -1.0 Gold price Real yields (inverted) 1,600 -0.5 0.0 1,300 Gold 0.5 1,000 1.0 '12 '13 '14 '15 '16 '17 Breakdown of world gold demand by sector Tonnes 2,500 2015 2,000 Q3 2016 ann. 1,500 1,000 500 0 -500 Other assets Jewellery Technology Total bar ETFs & Central bank and coin similar & other inst. demand products Source: (Top left) Thomson Reuters Datastream, J.P. Morgan Asset Management. (Bottom left) World Gold Council, J.P. Morgan Asset Management. (Right) FactSet, J.P. Morgan Asset Management. Guide to the Markets - UK. Data as of 31 December 2016. 72

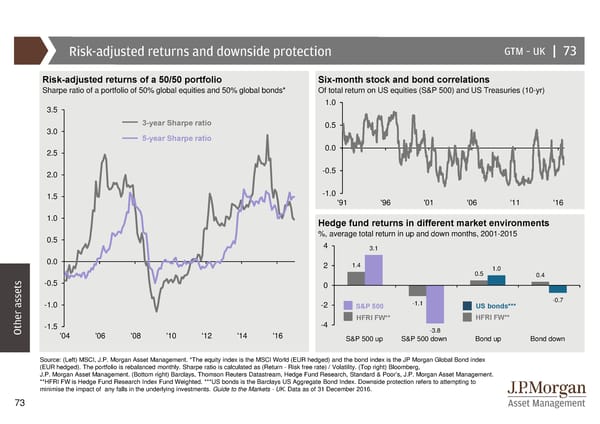

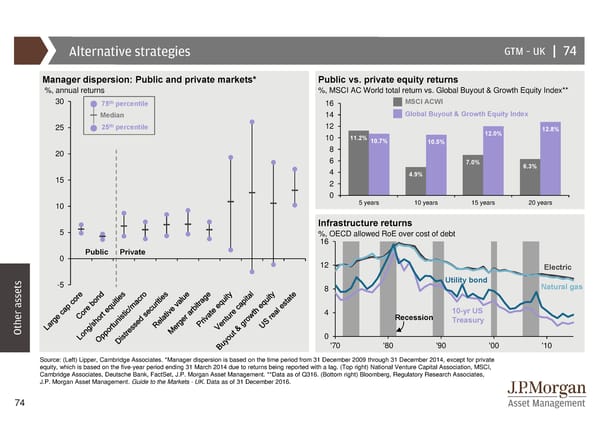

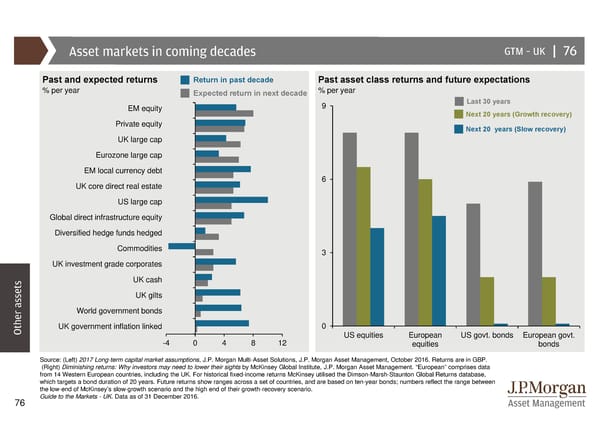

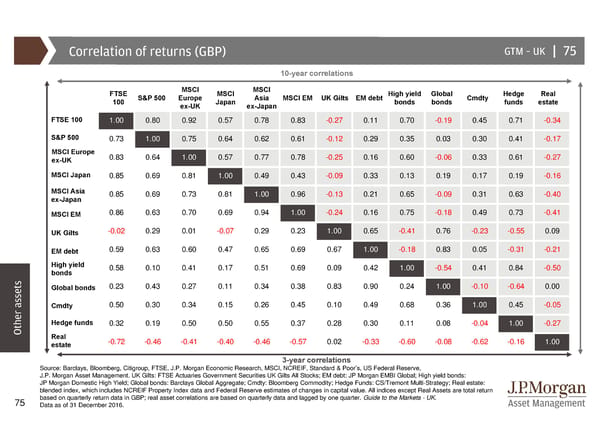

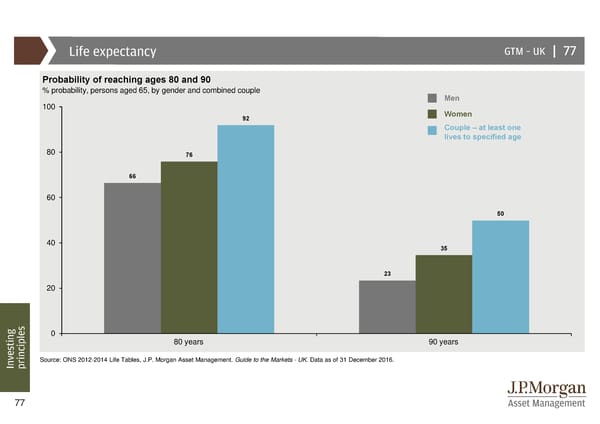

Risk-adjusted returns and downside protection GTM –UK | 73 Risk-adjusted returns of a 50/50 portfolio Six-month stock and bond correlations Sharpe ratio of a portfolio of 50% global equities and 50% global bonds* Of total return on US equities (S&P 500) and US Treasuries (10-yr) 3.5 1.0 3-year Sharpe ratio 0.5 3.0 5-year Sharpe ratio 2.5 0.0 2.0 -0.5 1.5 -1.0 '91 '96 '01 '06 '11 '16 1.0 Hedge fund returns in different market environments 0.5 %, average total return in up and down months, 2001-2015 4 3.1 0.0 2 1.4 0.5 1.0 0.4 -0.5 0 -1.0 -2 S&P 500 -1.1 US bonds*** -0.7 -4 HFRI FW** HFRI FW** Other assets-1.5 -3.8 '04 '06 '08 '10 '12 '14 '16 S&P 500 up S&P 500 down Bond up Bond down Source: (Left) MSCI, J.P. Morgan Asset Management. *The equity index is the MSCI World (EUR hedged) and the bond index is the JP Morgan Global Bond index (EUR hedged). The portfolio is rebalanced monthly. Sharpe ratio is calculated as (Return - Risk free rate) / Volatility. (Top right) Bloomberg, J.P. Morgan Asset Management. (Bottom right) Barclays, Thomson Reuters Datastream, Hedge Fund Research, Standard & Poor’s, J.P. Morgan Asset Management. **HFRI FW is Hedge Fund Research Index Fund Weighted. ***US bonds is the Barclays US Aggregate Bond Index. Downside protection refers to attempting to minimise the impact of any falls in the underlying investments. Guide to the Markets - UK. Data as of 31 December 2016. 73