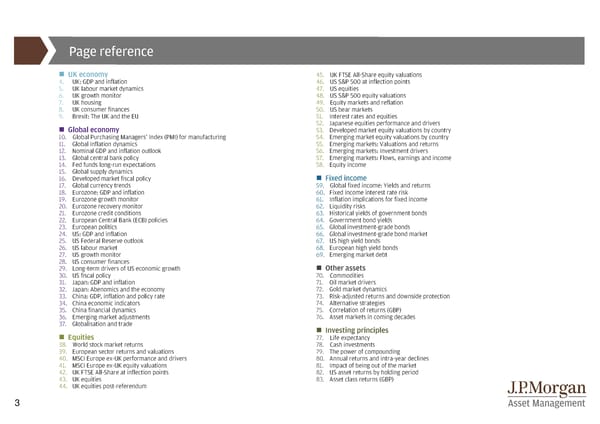

Page reference UK economy 45. UK FTSE All-Share equity valuations 4. UK: GDP and inflation 46. US S&P 500 at inflection points 5. UK labour market dynamics 47. US equities 6. UK growth monitor 48. US S&P 500 equity valuations 7. UK housing 49. Equity markets and reflation 8. UK consumer finances 50. US bear markets 9. Brexit: The UK and the EU 51. Interest rates and equities Global economy 52. Japanese equities performance and drivers 53. Developed market equity valuations by country 10. Global Purchasing Managers Index (PMI) for manufacturing 54. Emerging market equity valuations by country 11. Global inflation dynamics 55. Emerging markets: Valuations and returns 12. Nominal GDP and inflation outlook 56. Emerging markets: Investment drivers 13. Global central bank policy 57. Emerging markets: Flows, earnings and income 14. Fed funds long-run expectations 58. Equity income 15. Global supply dynamics Fixed income 16. Developed market fiscal policy 17. Global currency trends 59. Global fixed income: Yields and returns 18. Eurozone: GDP and inflation 60. Fixed income interest rate risk 19. Eurozone growth monitor 61. Inflation implications for fixed income 20. Eurozone recovery monitor 62. Liquidity risks 21. Eurozone credit conditions 63. Historical yields of government bonds 22. European Central Bank (ECB) policies 64. Government bond yields 23. European politics 65. Global investment-grade bonds 24. US: GDP and inflation 66. Global investment-grade bond market 25. US Federal Reserve outlook 67. US high yield bonds 26. US labour market 68. European high yield bonds 27. US growth monitor 69. Emerging market debt 28. US consumer finances Other assets 29. Long-term drivers of US economic growth 30. US fiscal policy 70. Commodities 31. Japan: GDP and inflation 71. Oil market drivers 32. Japan: Abenomics and the economy 72. Gold market dynamics 33. China: GDP, inflation and policy rate 73. Risk-adjusted returns and downside protection 34. China economic indicators 74. Alternative strategies 35. China financial dynamics 75. Correlation of returns (GBP) 36. Emerging market adjustments 76. Asset markets in coming decades 37. Globalisation and trade Investing principles Equities 77. Life expectancy 38. World stock market returns 78. Cash investments 39. European sector returns and valuations 79. The power of compounding 40. MSCI Europe ex-UK performance and drivers 80. Annual returns and intra-year declines 41. MSCI Europe ex-UK equity valuations 81. Impact of being out of the market 42. UK FTSE All-Share at inflection points 82. US asset returns by holding period 43. UK equities 83. Asset class returns (GBP) 44. UK equities post-referendum 3

Guide to the Markets Page 2 Page 4

Guide to the Markets Page 2 Page 4