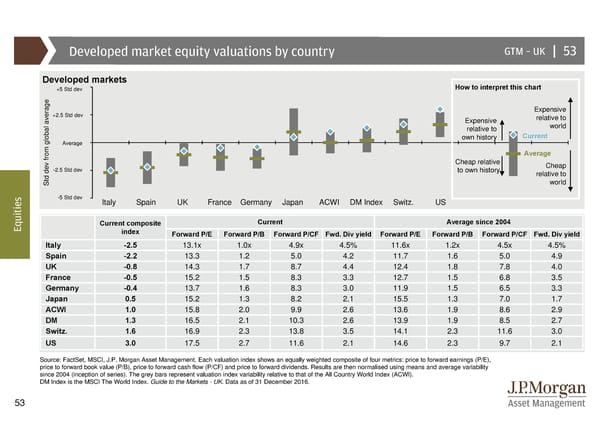

Developed market equity valuations by country GTM –UK | 53 Developed markets How to interpret this chart +5 Std dev +2.5 Std dev Expensive Expensive relative to relative to world global average own history Current Average Average Cheap relative Cheap -2.5 Std dev to own history relative to Std dev from world s -5 Std dev Italy Spain UK France Germany Japan ACWI DM Index Switz. US e i t i u Current Average since 2004 Eq Current composite index Forward P/E Forward P/B Forward P/CF Fwd. Divyield Forward P/E Forward P/B Forward P/CF Fwd. Divyield Italy -2.5 13.1x 1.0x 4.9x 4.5% 11.6x 1.2x 4.5x 4.5% Spain -2.2 13.3 1.2 5.0 4.2 11.7 1.6 5.0 4.9 UK -0.8 14.3 1.7 8.7 4.4 12.4 1.8 7.8 4.0 France -0.5 15.2 1.5 8.3 3.3 12.7 1.5 6.8 3.5 Germany -0.4 13.7 1.6 8.3 3.0 11.9 1.5 6.5 3.3 Japan 0.5 15.2 1.3 8.2 2.1 15.5 1.3 7.0 1.7 ACWI 1.0 15.8 2.0 9.9 2.6 13.6 1.9 8.6 2.9 DM 1.3 16.5 2.1 10.3 2.6 13.9 1.9 8.5 2.7 Switz. 1.6 16.9 2.3 13.8 3.5 14.1 2.3 11.6 3.0 US 3.0 17.5 2.7 11.6 2.1 14.6 2.3 9.7 2.1 Source: FactSet, MSCI, J.P. Morgan Asset Management. Each valuation index shows an equally weighted composite of four metrics: price to forward earnings (P/E), price to forward book value (P/B), price to forward cash flow (P/CF) and price to forward dividends. Results are then normalised using means and average variability since 2004 (inception of series). The grey bars represent valuation index variability relative to that of the All Country World Index (ACWI). DM Index is the MSCI The World Index. Guide to the Markets - UK. Data as of 31 December 2016. 53

Guide to the Markets Page 52 Page 54

Guide to the Markets Page 52 Page 54