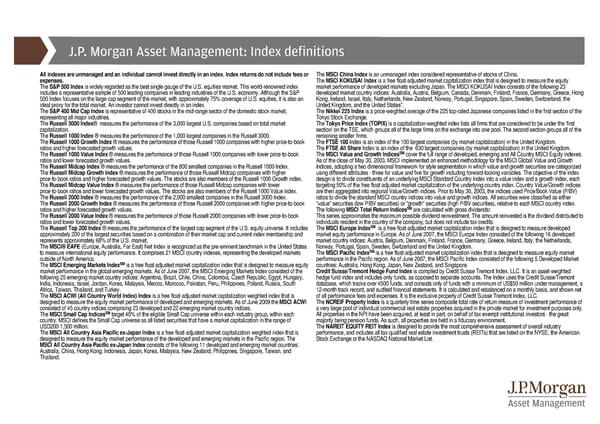

J.P. Morgan Asset Management: Index definitions All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or The MSCI China Index is an unmanaged index considered representative of stocks of China. expenses. The MSCI KOKUSAI Index is a free float-adjusted market capitalization index that is designed to measure the equity The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index market performance of developed markets excluding Japan. The MSCI KOKUSAI Index consists of the following 23 includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an Kong, Ireland, Israel, Italy, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the ideal proxy for the total market. An investor cannot invest directly in an index. United Kingdom, and the United States*. TheS&P 400 Mid Cap Index is representative of 400 stocks in the mid-range sector of the domestic stock market, The Nikkei 225 Index is a price-weighted average of the 225 top-rated Japanese companies listed in the first section of the representing all major industries. Tokyo Stock Exchange. The Russell 3000 Index® measures the performance of the 3,000 largest U.S. companies based on total market The Tokyo Price Index (TOPIX) is a capitalization-weighted index lists all firms that are considered to be under the 'first capitalization. section' on the TSE, which groups all of the large firms on the exchange into one pool. The second section groups all of the The Russell 1000 Index ® measures the performance of the 1,000 largest companies in the Russell 3000. remaining smaller firms. The Russell 1000 Growth Index ® measures the performance of those Russell 1000 companies with higher price-to-book The FTSE 100 Index is an index of the 100 largest companies (by market capitalization) in the United Kingdom. ratios and higher forecasted growth values. The FTSE All Share Index is an index of the 630 largest companies (by market capitalization) in the United Kingdom. SM The Russell 1000 Value Index ® measures the performance of those Russell 1000 companies with lower price-to-book The MSCI Value and Growth Indices cover the full range of developed, emerging and All Country MSCI Equity indexes. ratios and lower forecasted growth values. As of the close of May 30, 2003, MSCI implemented an enhanced methodology for the MSCI Global Value and Growth The Russell Midcap Index ® measures the performance of the 800 smallest companies in the Russell 1000 Index. Indices, adopting a two dimensional framework for style segmentation in which value and growth securities are categorized The Russell Midcap Growth Index ® measures the performance of those Russell Midcap companies with higher using different attributes - three for value and five for growth including forward-looking variables. The objective of the index price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000 Growth index. design is to divide constituents of an underlying MSCI Standard Country Index into a value index and a growth index, each The Russell Midcap Value Index ® measures the performance of those Russell Midcap companies with lower targeting 50% of the free float adjusted market capitalization of the underlying country index. Country Value/Growth indices price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000 Value index. are then aggregated into regional Value/Growth indices. Prior to May 30, 2003, the indices used Price/Book Value (P/BV) The Russell 2000 Index ® measures the performance of the 2,000 smallest companies in the Russell 3000 Index. ratios to divide the standard MSCI country indices into value and growth indices. All securities were classified as either The Russell 2000 Growth Index ® measures the performance of those Russell 2000 companies with higher price-to-book "value" securities (low P/BV securities) or "growth" securities (high P/BV securities), relative to each MSCI country index. SM are calculated with gross dividends: ratios and higher forecasted growth values. The following MSCI Total Return Indices The Russell 2000 Value Index ® measures the performance of those Russell 2000 companies with lower price-to-book This series approximates the maximum possible dividend reinvestment. The amount reinvested is the dividend distributed to ratios and lower forecasted growth values. individuals resident in the country of the company, but does not include tax credits. The Russell Top 200 Index ® measures the performance of the largest cap segment of the U.S. equity universe. It includes The MSCI Europe IndexSM is a free float-adjusted market capitalization index that is designed to measure developed approximately 200 of the largest securities based on a combination of their market cap and current index membership and market equity performance in Europe. As of June 2007, the MSCI Europe Index consisted of the following 16 developed represents approximately 68% of the U.S. market. market country indices: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, The MSCI® EAFE(Europe, Australia, Far East) Net Index is recognized as the pre-eminent benchmark in the United States Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. SM to measure international equity performance. It comprises 21 MSCI country indexes, representing the developed markets The MSCI Pacific Index is a free float-adjusted market capitalization index that is designed to measure equity market outside of North America. performance in the Pacific region. As of June 2007, the MSCI Pacific Index consisted of the following 5 Developed Market The MSCI Emerging Markets IndexSMis a free float-adjusted market capitalization index that is designed to measure equity countries: Australia, Hong Kong, Japan, New Zealand, and Singapore. market performance in the global emerging markets. As of June 2007, the MSCI Emerging Markets Index consisted of the Credit Suisse/Tremont Hedge Fund Index is compiled by Credit Suisse Tremont Index, LLC. It is an asset-weighted following 25 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, hedge fund index and includes only funds, as opposed to separate accounts. The Index uses the Credit Suisse/Tremont India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South database, which tracks over 4500 funds, and consists only of funds with a minimum of US$50 million under management, a Africa, Taiwan, Thailand, and Turkey. 12-month track record, and audited financial statements. It is calculated and rebalanced on a monthly basis, and shown net The MSCI ACWI (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is of all performance fees and expenses. It is the exclusive property of Credit Suisse Tremont Index, LLC. designed to measure the equity market performance of developed and emerging markets. As of June 2009 the MSCI ACWI The NCREIF Property Index is a quarterly time series composite total rate of return measure of investment performance of consisted of 45 country indices comprising 23 developed and 22 emerging market country indices. a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. The MSCI Small Cap IndicesSM target 40% of the eligible Small Cap universe within each industry group, within each All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors - the great country. MSCI defines the Small Cap universe as all listed securities that have a market capitalization in the range of majority being pension funds. As such, all properties are held in a fiduciary environment. USD200-1,500 million. The NAREIT EQUITY REIT Index is designed to provide the most comprehensive assessment of overall industry The MSCI All Country Asia Pacific ex-Japan Index is a free float-adjusted market capitalization weighted index that is performance, and includes all tax-qualified real estate investment trusts (REITs) that are listed on the NYSE, the American designed to measure the equity market performance of the developed and emerging markets in the Pacific region. The Stock Exchange or the NASDAQ National Market List. MSCI All Country Asia Pacific ex-Japan Index consists of the following 11 developed and emerging market countries: Australia, China, Hong Kong, Indonesia, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan, and Thailand.

Guide to the Markets Page 83 Page 85

Guide to the Markets Page 83 Page 85