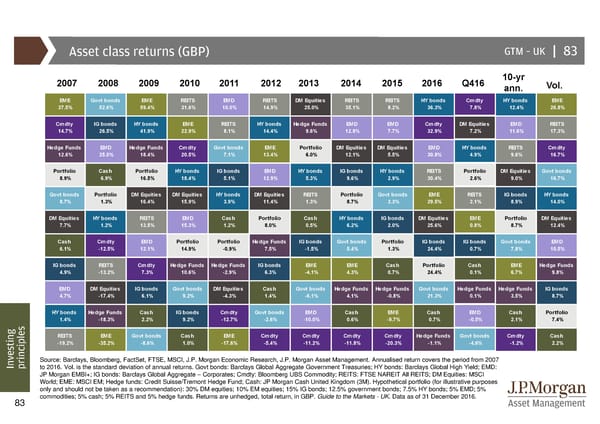

Asset class returns (GBP) GTM–UK | 83 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q416 10-yr Vol. ann. EME Govt bonds EME REITS EMD REITS DM Equities REITS REITS HY bonds Cmdty HY bonds EME 37.5% 52.6% 59.4% 31.6% 10.0% 14.9% 25.0% 35.1% 8.2% 36.3% 7.8% 12.4% 26.8% Cmdty IG bonds HY bonds EME REITS HY bonds Hedge Funds EMD EMD Cmdty DM Equities EMD REITS 14.7% 26.5% 41.9% 22.9% 8.1% 14.4% 9.6% 12.8% 7.7% 32.9% 7.2% 11.6% 17.3% Hedge Funds EMD Hedge Funds Cmdty Govt bonds EME Portfolio DM Equities DM Equities EMD HY bonds REITS Cmdty 12.6% 25.0% 18.4% 20.5% 7.1% 13.4% 6.0% 12.1% 5.5% 30.8% 4.9% 9.6% 16.7% Portfolio Cash Portfolio HY bonds IG bonds EMD HY bonds IG bonds HY bonds REITS Portfolio DM Equities Govt bonds 8.9% 6.9% 16.5% 18.4% 5.1% 12.9% 5.3% 9.6% 2.9% 30.4% 2.6% 9.0% 16.7% Govt bonds Portfolio DM Equities DM Equities HY bonds DM Equities REITS Portfolio Govt bonds EME REITS IG bonds HY bonds 8.7% 1.3% 16.4% 15.9% 3.9% 11.4% 1.3% 8.7% 2.3% 29.5% 2.1% 8.9% 14.0% DM Equities HY bonds REITS EMD Cash Portfolio Cash HY bonds IG bonds DM Equities EME Portfolio DM Equities 7.7% 1.2% 13.5% 15.3% 1.2% 8.0% 0.5% 6.2% 2.0% 25.6% 0.8% 8.7% 12.4% Cash Cmdty EMD Portfolio Portfolio Hedge Funds IG bonds Govt bonds Portfolio IG bonds IG bonds Govt bonds EMD 6.1% -12.5% 12.1% 14.9% -0.9% 7.5% -1.5% 5.4% 1.3% 24.4% 0.7% 7.8% 10.5% IG bonds REITS Cmdty Hedge Funds Hedge Funds IG bonds EME EME Cash Portfolio Cash EME Hedge Funds 4.9% -13.2% 7.3% 10.6% -2.9% 6.3% -4.1% 4.3% 0.7% 24.4% 0.1% 6.7% 9.8% EMD DM Equities IG bonds Govt bonds DM Equities Cash Govt bonds Hedge Funds Hedge Funds Govt bonds Hedge Funds Hedge Funds IG bonds 4.7% -17.4% 6.1% 9.2% -4.3% 1.4% -6.1% 4.1% -0.8% 21.3% 0.1% 3.5% 8.7% HY bonds Hedge Funds Cash IG bonds Cmdty Govt bonds EMD Cash EME Cash EMD Cash Portfolio 1.4% -18.3% 2.2% 9.2% -12.7% -2.6% -10.0% 0.6% -9.7% 0.7% -0.5% 2.1% 7.4% REITS EME Govt bonds Cash EME Cmdty Cmdty Cmdty Cmdty Hedge Funds Govt bonds Cmdty Cash sting -19.2% -35.2% -8.6% 1.0% -17.6% -5.4% -11.2% -11.8% -20.3% -1.1% -4.6% -1.2% 2.2% e v Source: Barclays, Bloomberg, FactSet, FTSE, MSCI, J.P. Morgan Economic Research, J.P. Morgan Asset Management. Annualised return covers the period from 2007 In principlesto 2016. Vol. is the standard deviation of annual returns. Govt bonds: Barclays Global Aggregate Government Treasuries; HY bonds: Barclays Global High Yield; EMD: JP Morgan EMBI+; IG bonds: Barclays Global Aggregate – Corporates; Cmdty: Bloomberg UBS Commodity; REITS: FTSE NAREIT All REITS; DM Equities: MSCI World; EME: MSCI EM; Hedge funds: Credit Suisse/Tremont Hedge Fund; Cash: JP Morgan Cash United Kingdom (3M). Hypothetical portfolio (for illustrative purposes only and should not be taken as a recommendation): 30% DM equities; 10% EM equities; 15% IG bonds; 12.5% government bonds; 7.5% HY bonds; 5% EMD; 5% commodities; 5% cash; 5% REITS and 5% hedge funds. Returns are unhedged, total return, in GBP. Guide to the Markets - UK. Data as of 31 December 2016. 83

Guide to the Markets Page 82 Page 84

Guide to the Markets Page 82 Page 84