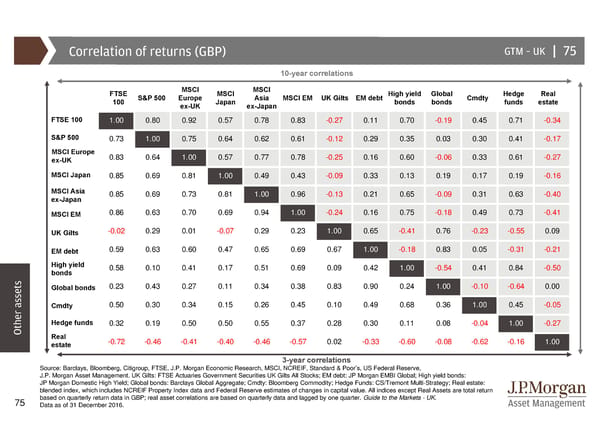

Correlation of returns (GBP) GTM–UK | 75 10-year correlations FTSE MSCI MSCI MSCI High yield Global Hedge Real 100 S&P 500 Europe Japan Asia MSCI EM UK Gilts EM debt bonds bonds Cmdty funds estate ex-UK ex-Japan FTSE 100 1.00 0.80 0.92 0.57 0.78 0.83 -0.27 0.11 0.70 -0.19 0.45 0.71 -0.34 S&P 500 0.73 1.00 0.75 0.64 0.62 0.61 -0.12 0.29 0.35 0.03 0.30 0.41 -0.17 MSCI Europe 0.83 0.64 1.00 0.57 0.77 0.78 -0.25 0.16 0.60 -0.06 0.33 0.61 -0.27 ex-UK MSCI Japan 0.85 0.69 0.81 1.00 0.49 0.43 -0.09 0.33 0.13 0.19 0.17 0.19 -0.16 MSCI Asia 0.85 0.69 0.73 0.81 1.00 0.96 -0.13 0.21 0.65 -0.09 0.31 0.63 -0.40 ex-Japan MSCI EM 0.86 0.63 0.70 0.69 0.94 1.00 -0.24 0.16 0.75 -0.18 0.49 0.73 -0.41 UK Gilts -0.02 0.29 0.01 -0.07 0.29 0.23 1.00 0.65 -0.41 0.76 -0.23 -0.55 0.09 EM debt 0.59 0.63 0.60 0.47 0.65 0.69 0.67 1.00 -0.18 0.83 0.05 -0.31 -0.21 High yield 0.58 0.10 0.41 0.17 0.51 0.69 0.09 0.42 1.00 -0.54 0.41 0.84 -0.50 bonds Global bonds 0.23 0.43 0.27 0.11 0.34 0.38 0.83 0.90 0.24 1.00 -0.10 -0.64 0.00 Cmdty 0.50 0.30 0.34 0.15 0.26 0.45 0.10 0.49 0.68 0.36 1.00 0.45 -0.05 Other assetsHedge funds 0.32 0.19 0.50 0.50 0.55 0.37 0.28 0.30 0.11 0.08 -0.04 1.00 -0.27 Real -0.72 -0.46 -0.41 -0.40 -0.46 -0.57 0.02 -0.33 -0.60 -0.08 -0.62 -0.16 1.00 estate 3-year correlations Source: Barclays, Bloomberg, Citigroup, FTSE, J.P. Morgan Economic Research, MSCI, NCREIF, Standard & Poor’s, US Federal Reserve, J.P. Morgan Asset Management. UK Gilts: FTSE Actuaries Government Securities UK Gilts All Stocks; EM debt: JP Morgan EMBI Global; High yield bonds: JP Morgan Domestic High Yield; Global bonds: Barclays Global Aggregate; Cmdty: Bloomberg Commodity; Hedge Funds: CS/Tremont Multi-Strategy; Real estate: blended index, which includes NCREIF Property Index data and Federal Reserve estimates of changes in capital value. All indices except Real Assets are total return based on quarterly return data in GBP; real asset correlations are based on quarterly data and lagged by one quarter. Guide to the Markets - UK. 75 Data as of 31 December 2016.

Guide to the Markets Page 74 Page 76

Guide to the Markets Page 74 Page 76