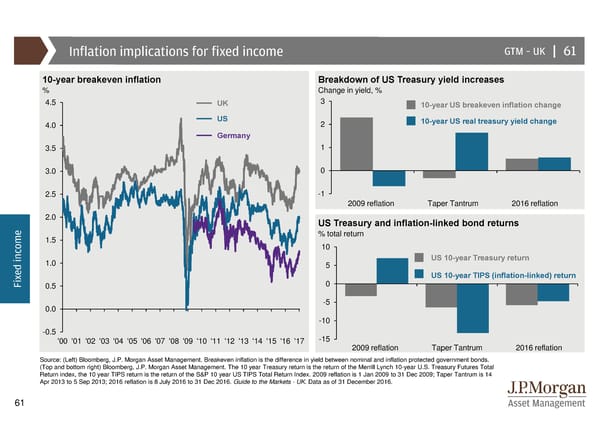

Inflation implications for fixed income GTM –UK | 61 10-year breakeven inflation Breakdown of US Treasury yield increases % Change in yield, % 4.5 UK 3 10-year US breakeven inflation change 4.0 US 2 10-year US real treasury yield change Germany 3.5 1 3.0 0 2.5 -1 2009 reflation Taper Tantrum 2016 reflation 2.0 US Treasury and inflation-linked bond returns e % total return m 1.5 o 10 c n US 10-year Treasury return i 1.0 5 d e US 10-year TIPS (inflation-linked) return x Fi 0.5 0 0.0 -5 -10 -0.5 -15 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 2009 reflation Taper Tantrum 2016 reflation Source: (Left) Bloomberg, J.P. Morgan Asset Management. Breakeven inflation is the difference in yield between nominal and inflation protected government bonds. (Top and bottom right) Bloomberg, J.P. Morgan Asset Management. The 10 year Treasury return is the return of the Merrill Lynch 10-year U.S. Treasury Futures Total Return index, the 10 year TIPS return is the return of the S&P 10 year US TIPS Total Return Index. 2009 reflation is 1 Jan 2009 to 31 Dec 2009; Taper Tantrum is 14 Apr 2013 to 5 Sep 2013; 2016 reflation is 8 July 2016 to 31 Dec 2016. Guide to the Markets - UK. Data as of 31 December 2016. 61

Guide to the Markets Page 60 Page 62

Guide to the Markets Page 60 Page 62