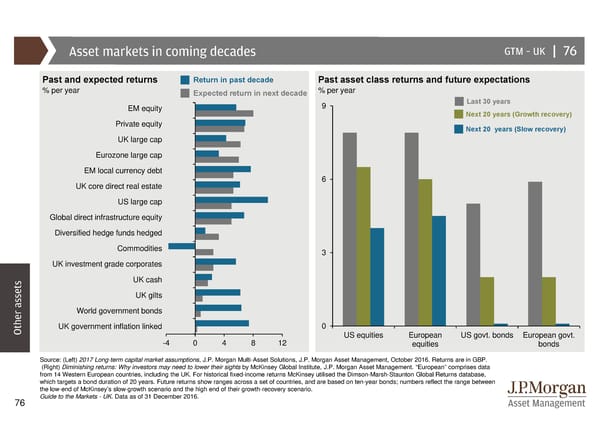

Asset markets in coming decades GTM –UK | 76 Past and expected returns Return in past decade Past asset class returns and future expectations % per year Expected return in next decade % per year EM equity 9 Last 30 years Next 20 years (Growth recovery) Private equity Next 20 years (Slow recovery) UK large cap Eurozone large cap EM local currency debt UK core direct real estate 6 US large cap Global direct infrastructure equity Diversified hedge funds hedged Commodities 3 UK investment grade corporates UK cash UK gilts World government bonds Other assetsUK government inflation linked 0 -404812 US equities European US govt. bonds European govt. equities bonds Source: (Left) 2017 Long-term capital market assumptions, J.P. Morgan Multi-Asset Solutions, J.P. Morgan Asset Management, October 2016. Returns are in GBP. (Right) Diminishing returns: Why investors may need to lower their sights by McKinsey Global Institute, J.P. Morgan Asset Management. “European” comprises data from 14 Western European countries, including the UK. For historical fixed-income returns McKinsey utilised the Dimson-Marsh-Staunton Global Returns database, which targets a bond duration of 20 years. Future returns show ranges across a set of countries, and are based on ten-year bonds; numbers reflect the range between the low-end of McKinsey’s slow-growth scenario and the high end of their growth-recovery scenario. Guide to the Markets - UK. Data as of 31 December 2016. 76

Guide to the Markets Page 75 Page 77

Guide to the Markets Page 75 Page 77