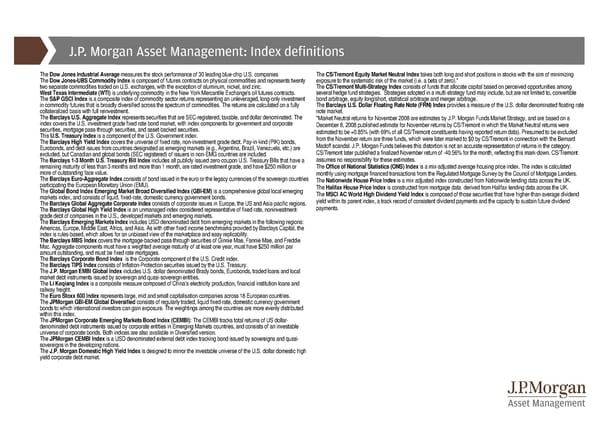

J.P. Morgan Asset Management: Index definitions The Dow Jones Industrial Averagemeasures the stock performance of 30 leading blue-chip U.S. companies The CS/Tremont Equity Market Neutral Index takes both long and short positions in stocks with the aim of minimizing The Dow Jones-UBS Commodity Index is composed of futures contracts on physical commodities and represents twenty exposure to the systematic risk of the market (i.e. a beta of zero).* two separate commodities traded on U.S. exchanges, with the exception of aluminum, nickel, and zinc. The CS/Tremont Multi-Strategy Index consists of funds that allocate capital based on perceived opportunities among West Texas Intermediate (WTI) is underlying commodity in the New York Mercantile Exchange's oil futures contracts. several hedge fund strategies. Strategies adopted in a multi-strategy fund may include, but are not limited to, convertible The S&P GSCI Index is a composite index of commodity sector returns representing an unleveraged, long-only investment bond arbitrage, equity long/short, statistical arbitrage and merger arbitrage. in commodity futures that is broadly diversified across the spectrum of commodities. The returns are calculated on a fully The Barclays U.S. Dollar Floating Rate Note (FRN) Index provides a measure of the U.S. dollar denominated floating rate collateralized basis with full reinvestment. note market. The Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The *Market Neutral returns for November 2008 are estimates by J.P. Morgan Funds Market Strategy, and are based on a index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate December 8, 2008 published estimate for November returns by CS/Tremont in which the Market Neutral returns were securities, mortgage pass-through securities, and asset-backed securities. estimated to be +0.85% (with 69% of all CS/Tremont constituents having reported return data). Presumed to be excluded This U.S. Treasury Index is a component of the U.S. Government index. from the November return are three funds, which were later marked to $0 by CS/Tremont in connection with the Bernard The Barclays High Yield Index covers the universe of fixed rate, non-investment grade debt. Pay-in-kind (PIK) bonds, Madoff scandal. J.P. Morgan Funds believes this distortion is not an accurate representation of returns in the category. Eurobonds, and debt issues from countries designated as emerging markets (e.g., Argentina, Brazil, Venezuela, etc.) are CS/Tremont later published a finalized November return of -40.56% for the month, reflecting this mark-down. CS/Tremont excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. assumes no responsibility for these estimates. The Barclays 1-3 Month U.S. Treasury Bill Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or The Office of National Statistics (ONS) Index is a mix-adjusted average housing price index. The index is calculated more of outstanding face value. monthly using mortgage financed transactions from the Regulated Mortgage Survey by the Council of Mortgage Lenders. The Barclays Euro-Aggregate Index consists of bond issued in the euro or the legacy currencies of the sovereign countries The Nationwide House Price Index is a mix adjusted index constructed from Nationwide lending data across the UK. participating the European Monetary Union (EMU). The Halifax House Price Index is constructed from mortgage data derived from Halifax lending data across the UK. The Global Bond Index Emerging Market Broad Diversified Index (GBI-EM) is a comprehensive global local emerging The MSCI AC World High Dividend Yield Index is composed of those securities that have higher-than-average dividend markets index, and consists of liquid, fixed-rate, domestic currency government bonds. yield within its parent index, a track record of consistent dividend payments and the capacity to sustain future dividend The Barclays Global Aggregate Corporate Index consists of corporate issues in Europe, the US and Asia-pacific regions. payments. TheBarclays Global High Yield Index is an unmanaged index considered representative of fixed rate, noninvestment- grade debt of companies in the U.S., developed markets and emerging markets. The Barclays Emerging Markets Index includes USD-denominated debt from emerging markets in the following regions: Americas, Europe, Middle East, Africa, and Asia. As with other fixed income benchmarks provided by Barclays Capital, the index is rules-based, which allows for an unbiased view of the marketplace and easy replicability. The Barclays MBS Index covers the mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae, and Freddie Mac. Aggregate components must have a weighted average maturity of at least one year, must have $250 million par amount outstanding, and must be fixed rate mortgages. The Barclays Corporate Bond Index is the Corporate component of the U.S. Credit index. The Barclays TIPS Index consists of Inflation-Protection securities issued by the U.S. Treasury. The J.P. Morgan EMBI Global Index includes U.S. dollar denominated Brady bonds, Eurobonds, traded loans and local market debt instruments issued by sovereign and quasi-sovereign entities. The Li Keqiang Index is a composite measure composed of China’s electricity production, financial institution loans and railway freight. The Euro Stoxx 600 Index represents large, mid and small capitalisation companies across 18 European countries. The JPMorgan GBI-EM Global Diversified consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. The JPMorgan Corporate Emerging Markets Bond Index (CEMBI): The CEMBI tracks total returns of US dollar- denominated debt instruments issued by corporate entities in Emerging Markets countries, and consists of an investable universe of corporate bonds. Both indices are also available in Diversified version. The JPMorgan CEMBI Index is a USD denominated external debt index tracking bond issued by sovereigns and quasi- sovereigns in the developing nations. The J.P. Morgan Domestic High Yield Index is designed to mirror the investable universe of the U.S. dollar domestic high yield corporate debt market.

Guide to the Markets Page 84 Page 86

Guide to the Markets Page 84 Page 86